The benefits of risk-based decision making

The benefits of risk-based decision making Risk. It’s an inescapable factor that must be considered when you operate in the B2B lending, brokerage and wider finance spheres. When it comes

When providing loans in the car financing and leasing sector, it’s very important to have a complete and clear financial profile of every applicant. Confirming applicant identities, background checks and credit history all play an essential role in the approval process.

Of course, ensuring you have highly accurate and reliable information on every applicant is often an expensive, time consuming process. But with our SalesTech automation platform, we make the car finance verification process cost-effective and almost instantaneous.

With SalesTech, we are able to bring highly-effective automation technology into the car financing, leasing and rental spheres. Our entirely bespoke platform allows you to use a range of apps to achieve the results you need.

From automatically performing soft credit checks on applicants with technology from the likes of Experian, to a range of automated identity verification apps. SalesTech always delivers accurate and easy-to-understand data on every applicant.

When leasing a car, it’s essential that you can rely on your customers to make payments. The SalesTech business intelligence platform uses a decision engine to automatically determine whether or not a customer would be eligible by utilising a range of factors.

We automatically check to see whether they are on the electoral roll, if they have any CCJs and check the DVLA’s database to ensure that you only encounter the most trustworthy applicants. With the information we pull from these sources, our automated decision engine can determine how eligible an applicant is for your service in seconds.

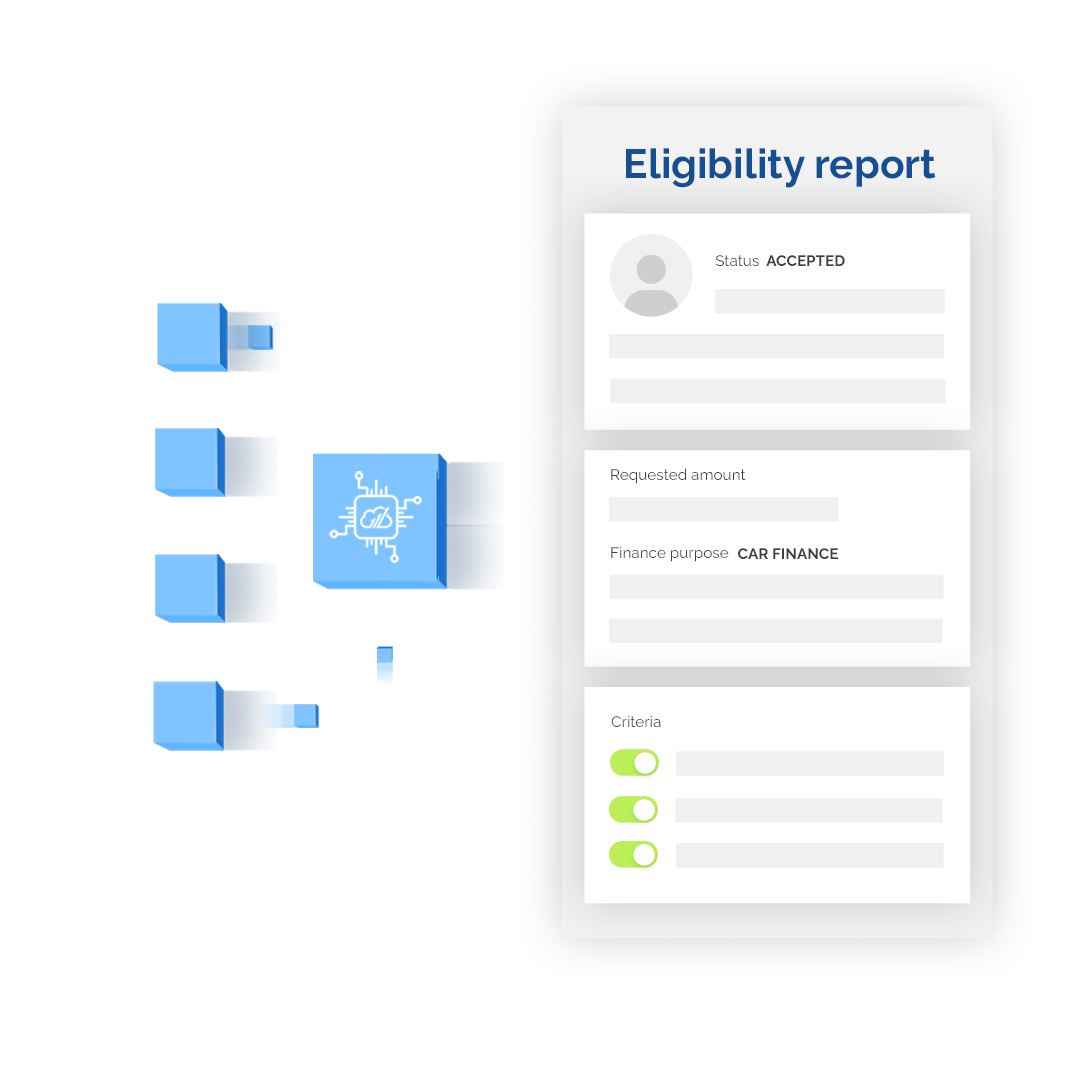

Once our decision engine has processed an application, you will automatically receive a report determining how eligible an applicant is. With an accurate financial profile of the applicant, you can either use our score-based system to automatically approve or reject the applicant based on your criteria, or do it manually. Whatever you choose, SalesTech will have compressed the verification process into no time at all – saving you time, money and manpower.

The benefits of risk-based decision making Risk. It’s an inescapable factor that must be considered when you operate in the B2B lending, brokerage and wider finance spheres. When it comes

Automating B2B due diligence Due diligence is an essential part of the onboarding process for any B2B organisation. When large sums of money are involved – as is the case

What is lead scoring and how can you do it efficiently? When working in the B2B space, assessing the quality of potential prospects is essential. This is especially important for

A step-by-step guide to checking the creditworthiness of a company Creditworthiness is key when it comes to offering financial services to businesses. From determining a business’ level of financial stability

Get started with LendTech today. Start processing hundreds of credit check applications in seconds!

We’ll just a need a few more details to get you setup on LendTech.

We’ve sent you a link to get you started with LendTech to