Imagine if your business could run by itself. That’s what we do here at Venture Motion, we build powerful, commercially-driven optimisation and automation solutions that enable your business to run seamlessly, even when you’re not around.

Why waste time and money on new strategies if you don’t know what’s holding you back? Our auditing and optimisation services dig deep to find what’s broken, what needs fixing, and where you can improve.

Before investing in new processes and campaigns, let us help you uncover hidden gaps in your SEO, website performance, CRM, communications, integrations, and workflows. We’ll show you exactly where to focus for the best results.

2023-2024 data from one client website

2023-2024 data from one client website

The Go-To MVP Development Specialists

Your day-to-day operations are unique to your business, so it only makes sense that your digital processes and operations should be unique too. There are hundreds of ready-built, off-the-shelf digital solutions available, but how many of them really tick all of your boxes?

At Venture Motion, we build custom digital solutions that solve your exact requirements.

Automation solutions for finance organisations

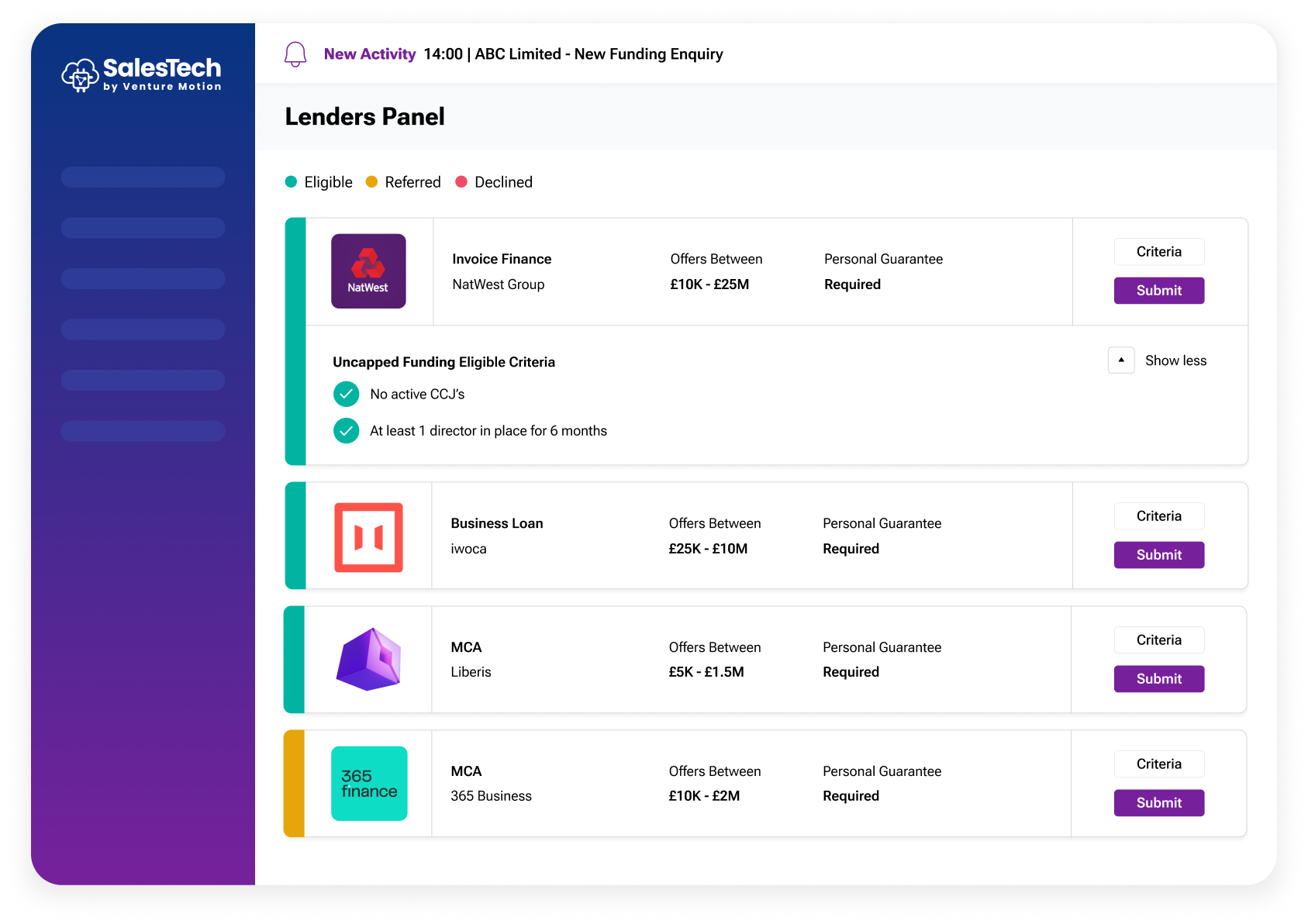

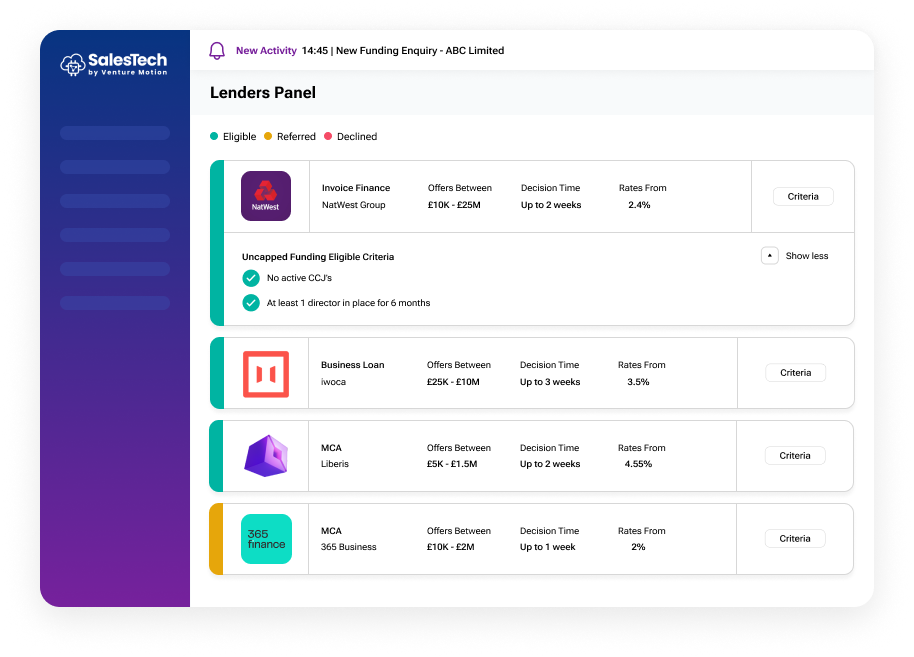

Our suite of finance technology business automation solutions, enable organisations in the finance and professional services sector to automate their operations and enhance decision making.

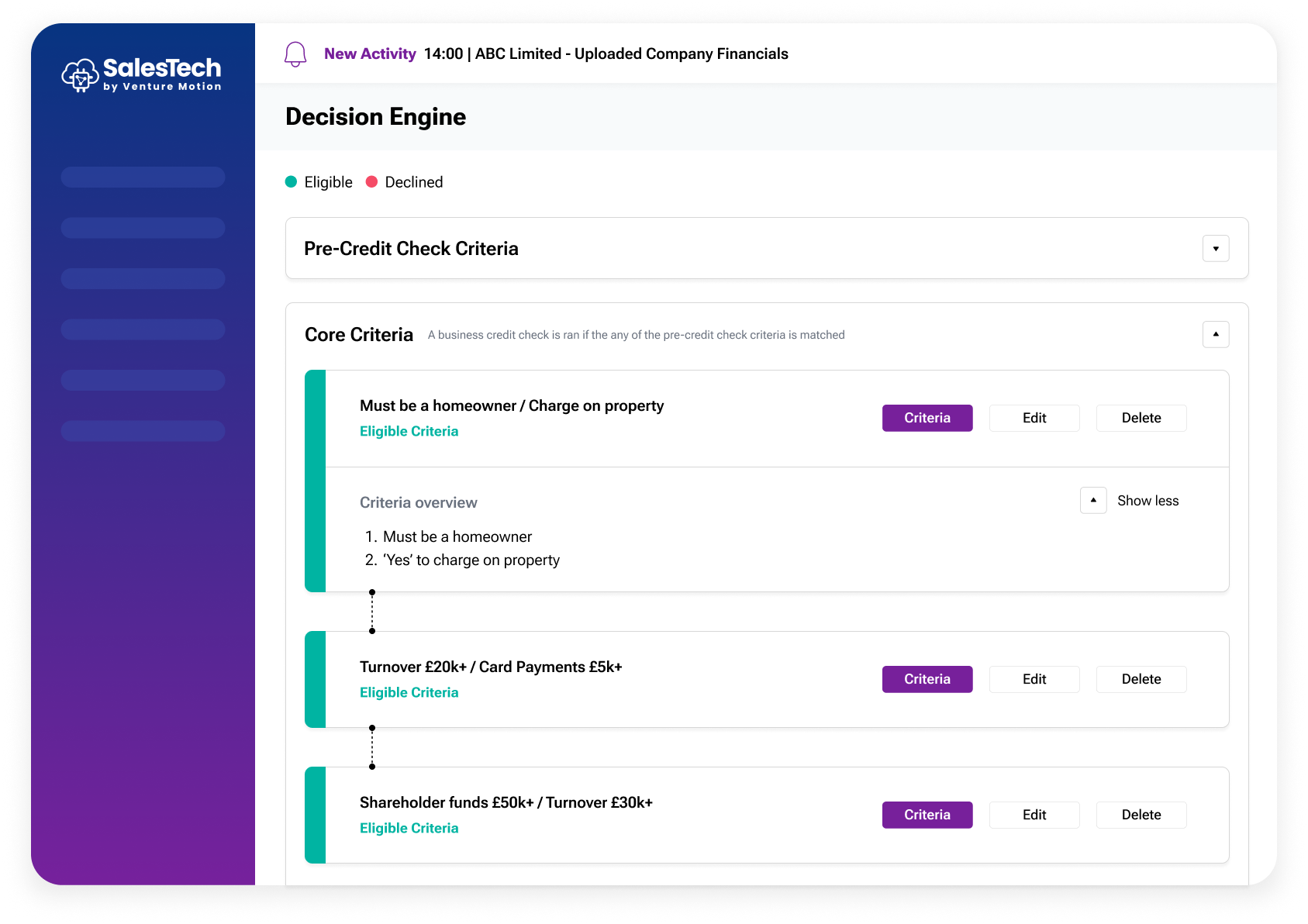

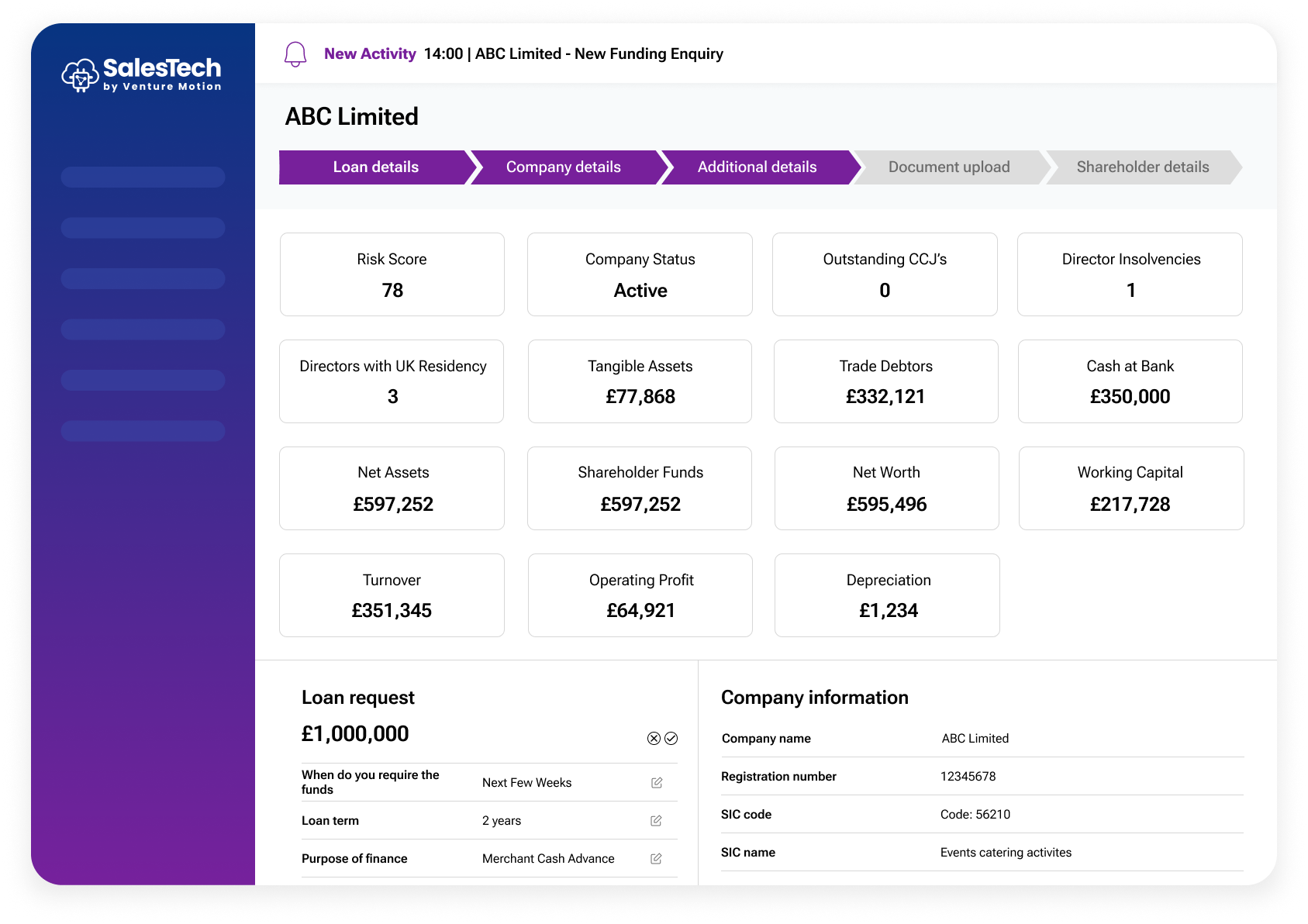

With our SalesTech decision engine at the heart of our solution, we enable finance organisations to automate time consuming qualification, due diligence and underwriting tasks, whilst aiding sales and marketing with realtime data.

Our suite of finance technology business automation solutions, enable organisations in the lending sector to automate their operations and enhance decision making.

With our SalesTech business intelligence platform at the heart of our solution, we enable finance organisations to automate time consuming underwriting tasks whilst aiding sales and marketing with realtime data.

Introducing

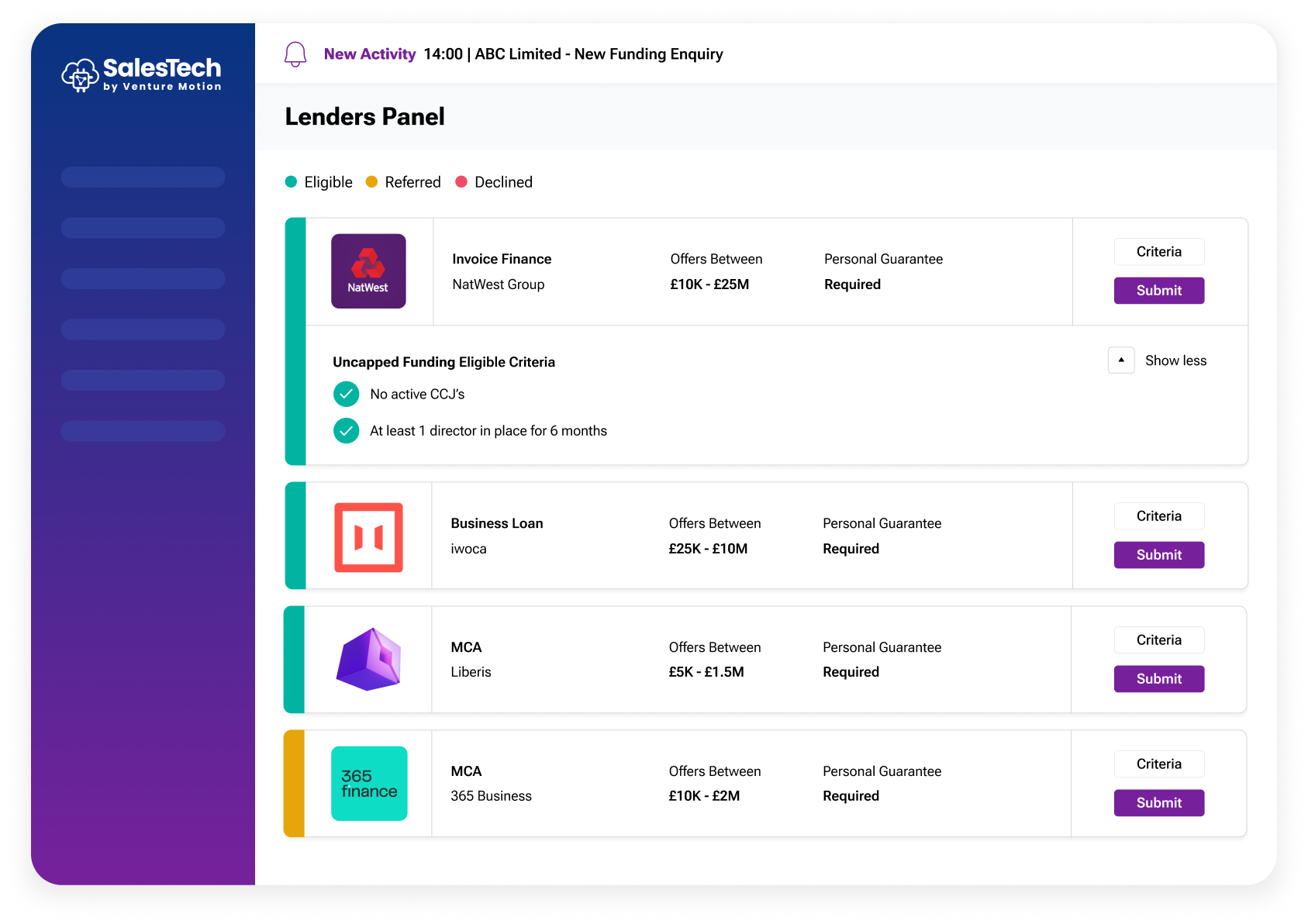

Our SalesTech Decision Engine has automatically qualified and underwritten over £84 million in finance applications across 90+ lenders for our finance clients. Our core engine processes over 3,000 data points every minute in real time, pulling from a range of data sources, including Creditsafe, Experian, Equifax, Companies House, Land Registry, Open Banking, and more APIs

Process hundreds of decisions and criteria sets in seconds against real-time data points pulling from a range of data sources including Creditsafe, Experian, Equifax, Companies House, Land Registry, Open Banking, and more APIs.

Instantly match your customers with multiple lenders or suppliers based on their requirements with our in-built lender configurator.

Creditsafe’s business credit API gives our decision engine access to credit data from millions of businesses across the UK.

One finance broker approached us with the goal of scaling up their organisation without increasing headcount. The answer to their problem; SalesTech Decision Engine. Automating their onboarding and pre-qualification process with our powerful proprietary decision engine resulted in an uplift of 300% in lead processing and faster funding from initial enquiry of up to 70%.

© Venture Motion Limited 2025