Lead qualification is a process that businesses can use to determine whether or not a lead has the characteristics that make them a good fit for a business’s products and services. Qualification involves evaluating a lead’s potential to become a paying customer based on a range of criteria specific to each sector and business.

In the B2B finance industry, qualifying leads has the additional impact of determining whether or not an inbound lead is a suitable candidate for business loans offered by lenders either from lenders directly or through a broker.

While the criteria used to determine the quality of a lead varies widely, there are some key aspects of the lead qualification process that remain mostly the same from sector to sector, business to business:

Identification

This involves recognising where a lead originated from which may impact the likelihood of a conversion. The source of a lead could be a marketing campaign, referral, website inquiry, an event, or something else entirely depending on the type of business.

Assessment

Assessment is often the most comprehensive part of the process, where the lead is evaluated against the individual business’s specific criteria to determine suitability. For the B2B finance industry, lenders, brokers and other businesses are likely to look at a lead’s financial stability, key people and shareholders and historic bankruptcies or CCJs.

Scoring

Following the assessment phase, the leads will likely be assigned a score based on how well they match the business’s specific criteria.

Prioritisation

With the leads assessed and scored, the business can now prioritise the inbound leads based on how likely they are to become customers. This involves focusing on and nurturing the high scorers, while placing less importance or, as is often the case in B2B finance, rejecting low-scoring leads entirely.

Lead scoring is an invaluable tool for businesses, especially in the world of B2B finance. However, it is an often long-winded, time-consuming and resource-intensive process. That’s where automation comes in.

We’ve explained the benefits of automated lead qualification at length, and we built SalesTech to help businesses in B2B finance qualify their leads quicker and more efficiently than ever, so they can focus on scaling their business.

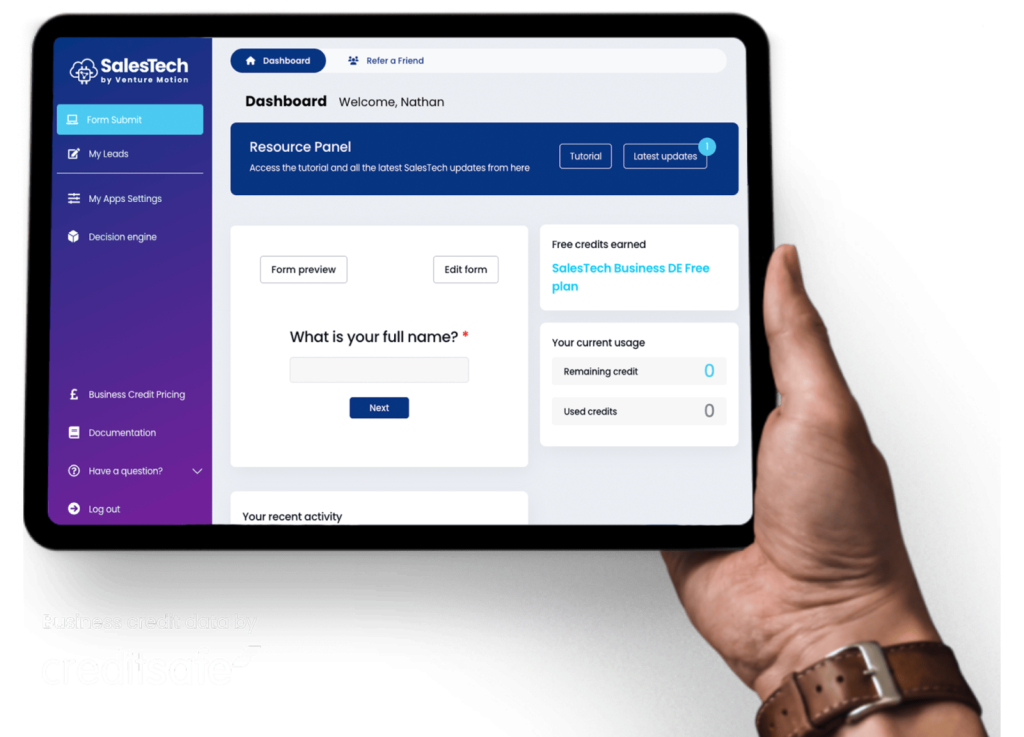

SalesTech is our lead qualification decision engine software that automates the lookup, due diligence, qualification and onboarding process for B2B financial institutions. Our software imports, reads, scores and qualifies leads based on data from Creditsafe, company data and any other specific criteria you have. Once qualified, the information is fed into our decision engine, allowing you to approve or deny applicants in seconds.

When you use SalesTech, you establish the criteria necessary to work with a company and we do the rest. Each applicant will be scored against your bespoke requirements and can be automatically approved or denied so you can allocate your time to more efficiently growing your business.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025