The KYC process is one of the most important aspects of commercial finance loan brokerage and is essential to matching borrowers with the right business lenders. With KYC automation tools, you can work through this process faster and more accurately to boost efficiency and ensure that only the best deals are approved.

KYC automation tools can take many forms, often forming part of a broader digital platform or software to enhance and automate tasks like identity verification, document collection and risk assessments. They can then integrate with decision engines and CRMs to streamline and enhance your broader business processes.

Save time

Time and efficiency is key in the commercial finance world, and the KYC process can often be a protracted one, with brokers spending hours waiting to receive applicant documents, analysing every factor and ensuring that they meet the requirements of your lenders. Automated KYC tools can do all of this almost instantly, giving you more time to build relationships with lenders and focus on building your business.

Ensure accuracy

As a broker, ensuring that applicants meet the specific requirements of each lender you work with, as well as any financial regulations, is of paramount importance. By removing room for human error in the details, automated KYC tools ensure a compliant process and can even match applicants with lenders based on their specifications.

Improve customer experience

Rather than having to pick up the phone or deal with back-and-forth email chains every time a potential deal arises, with an automated platform, your applicants will be able to upload their data directly into your system as it suits them. Plus, with automated Companies House analysis and credit score checks, the entire process is almost seamless for both parties.

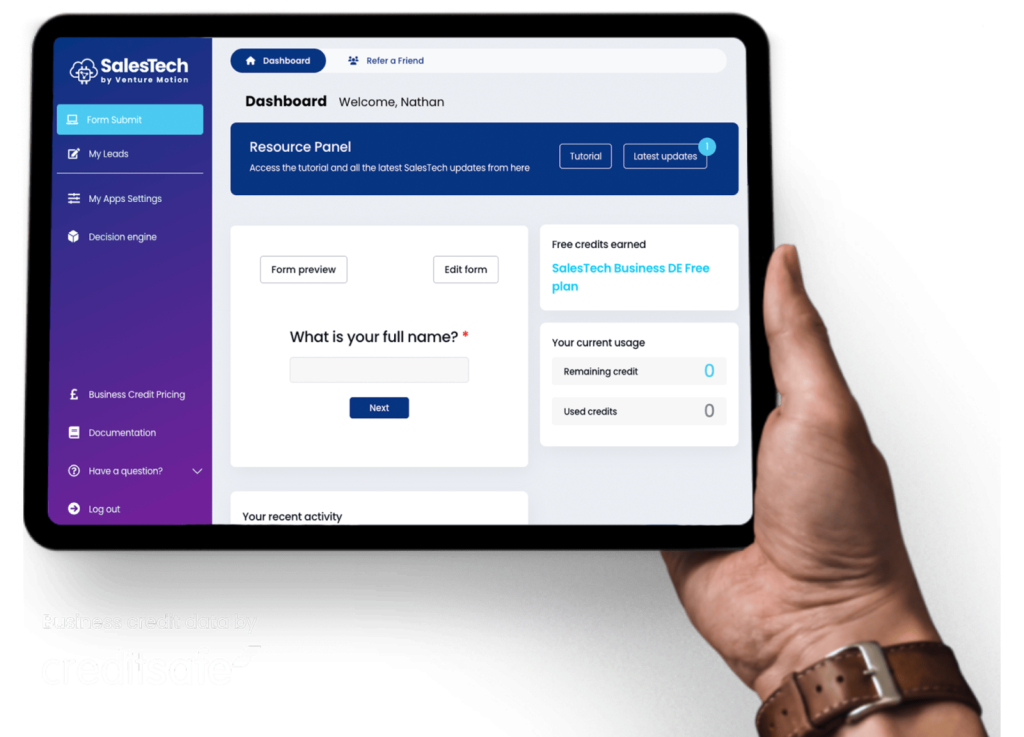

SalesTech, our commercial finance automation software is a platform built to provide the best possible experience to business finance professionals. Our KYC automation tools give brokers the ability to automate their entire deal process from initial data collection and KYC, through to pre-packaging deals and matching to lenders.

The SalesTech dashboard is also the ideal platform for finance professionals looking for a business finance CRM with live deal tracking, dashboards, a data collection hub and fully customisable fields.

For more information about how to automate your business finance lending and brokering, get in touch with one of our SalesTech product specialists today.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025