How to perform a credit analysis of a company

Analysing the credit of a company is essential to anyone planning on making a financial decision about a business. By acquiring a company credit report, analysing the data, and implementing your findings into the processes of your business, you’ll be able to effectively judge the financial stability and creditworthiness of prospective clients, customers and investment opportunities.

Knowing how to accurately and efficiently analyse the credit of a company, however, isn’t always obvious.

Company credit reports

Similarly to a personal credit report, the business credit reports provided by the likes of Creditsafe will highlight factors to help you assess the creditworthiness of a business. This can include the age of the company’s credit history, any recent credit enquiries, incorporation dates, the company’s SIC code and more.

While all of this information can be very useful, being able to understand what a business credit score is telling you and put that analysis into practice is where the true value lies.

How to analyse the credit of a company

At the core, credit analysis is the process undertaken by lenders and other organisations to understand the creditworthiness of a potential borrower, client, customer or partner. With a company credit report, you’ll have a wide range of information that can be beneficial to helping you understand the creditworthiness of a business.

Of course, no two businesses are alike, so it’s important to be able to fully understand each prospective business that you’ll work with by utilising information from a wide range of data points.

Beyond a simple assessment of a credit report, your analysis may also incorporate data from Companies House to determine whether the business you’re analysing has any CCJs or has filed for bankruptcy in the past. For many lenders and brokers, this information is as essential as understanding the credit history of a business.

Collating, analysing and implementing this company data into your underwriting or pre-qualification is essential, but can be complex and time consuming. As every business is different, doing a detailed credit analysis of a company can be a daunting task and take up a lot of time and effort from your team.

A better way to do company credit analysis

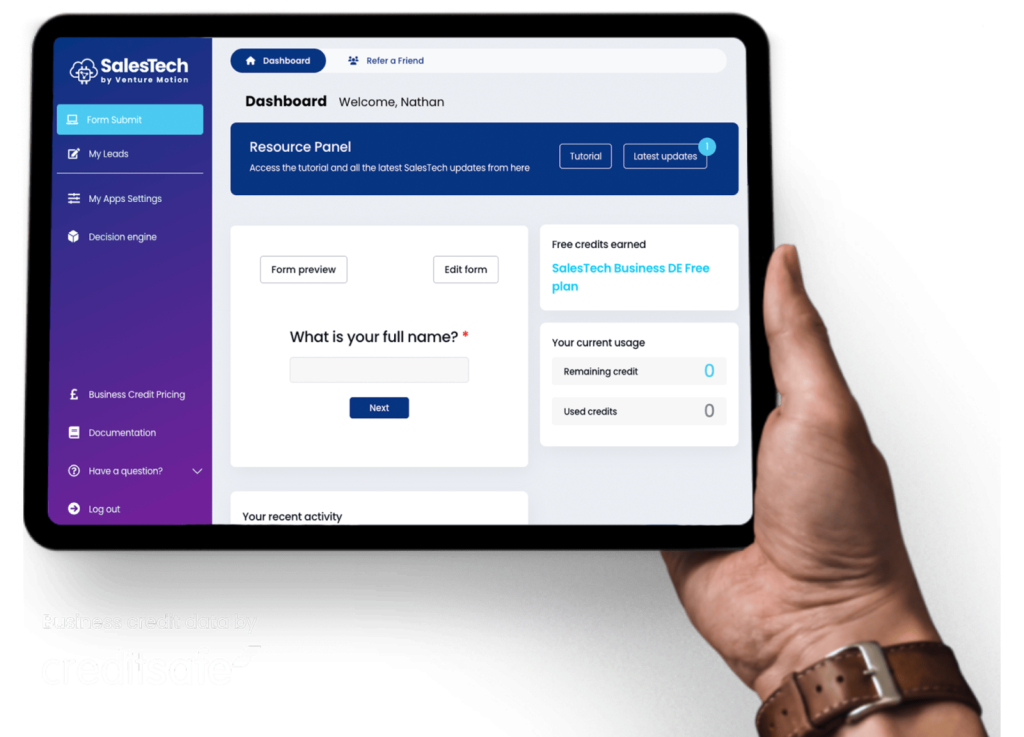

To combat the time and effort required by lenders, brokers, investors and other financial institutions looking to perform company credit analysis, we built our SalesTech platform. SalesTech is a business intelligence platform with a built in decision engine that collates relevant business data from business credit reference agencies and Companies House to provide a highly accurate, real-time analysis of any business you are considering working with.

Based on the criteria most important to your business, SalesTech pulls together a detailed analysis from multiple sources data points. This information is then fed into a powerful decision engine driven by AI technology that immediately scores potential businesses against your own specific requirements. In no time at all, you’ll have fully analysed the company credit of potential partners or clients and will be able to make decisions in no time at all.

For more information on how SalesTech can work for your business, get in touch with our team today.