Before you work with a company, particularly in the lending or brokerage industries, you must have a comprehensive understanding of how financially stable the company is. One of the most effective ways to check if a company is financially stable is through using Companies House data in conjunction with credit data held by business credit reference agencies such as Creditsafe.

With Companies House data and business credit checks available to you, it’s never been easier to assess the financial stability of a company.

Companies House holds detailed information on every limited company in the UK. This includes information regarding a company’s legitimacy, its directors, CCJ history and any insolvency or bankruptcy records that can prove invaluable to your financial assessments.

Here’s how to check company accounts and filing history with Companies House:

1. Visit the Companies House website

Navigate to the Companies House website.

2. Search for the company

Use the search function to find the company that you wish to check. You can search either by company name or registration number.

3. Review company details

Once you have found the company, click on it to access detailed information.

4. Navigate to the ‘Filing History’ section

Under the filing history tab, you’ll see the information previously filed by the company. This includes incorporation documents, annual statements and insolvency or bankruptcy documents.

For more detailed information regarding a company’s financial information including bankruptcy, credit scores and highly detailed credit reports on every company in the UK, you can utilise the information held by business credit reference agencies such as Creditsafe.

The information held by these agencies is far more detailed than the information at Companies House. It is highly effective for providing a more well-rounded summary of a business’s financial stability and, when used with your research into Companies House data, gives you a fully rounded understanding of how stable a business is from a financial perspective.

Unlike the information from Companies House, the reports produced by these agencies come at a financial cost, however.

Manually accessing insolvency data through Companies House and credit agencies is both time-consuming and expensive. Particularly if the company has a long and complicated filing history. However, this data is incredibly important and often integral to bringing on new business clients.

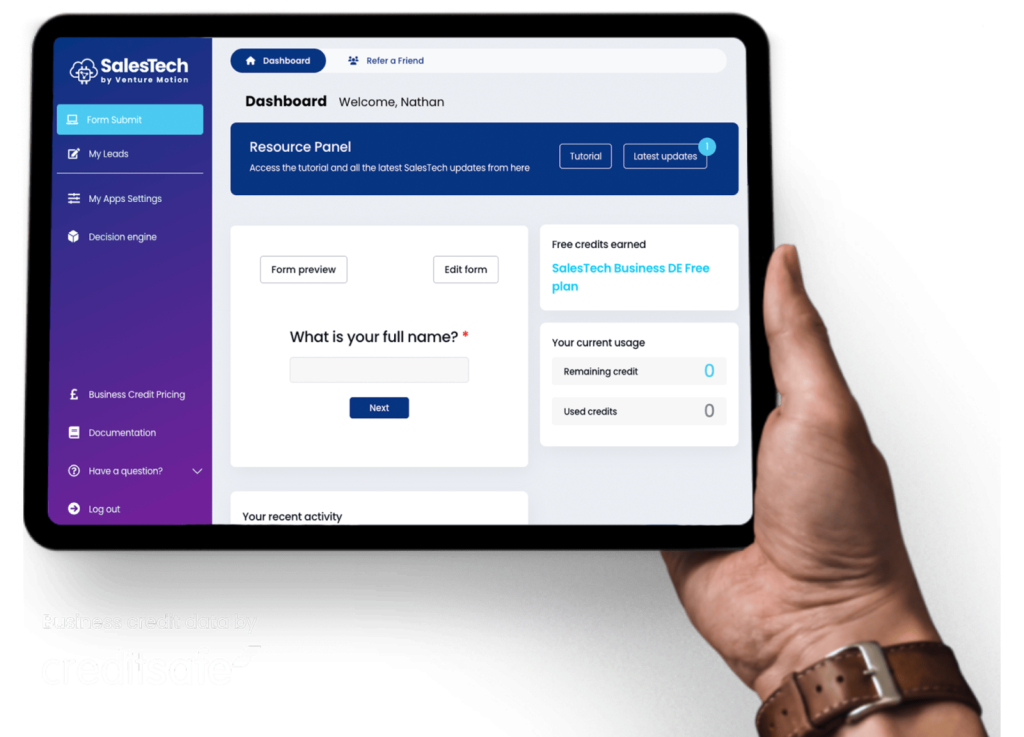

SalesTech is our business intelligence platform that seeks to automate the lookup, due diligence and onboarding process by integrating data from Companies House and business credit reference agencies with your existing processes.

When you use SalesTech, you establish the criteria necessary to work with a company – including any insolvency information – and we do the rest. Each applicant will be scored against your bespoke requirements and can be automatically approved or denied so you can allocate your time to more efficiently growing your business.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025