As a commercial finance broker, having access to a CRM to collate, manage and access your ongoing deals can be incredibly beneficial. But is there a CRM for finance brokers?

The short answer is yes, there are CRMs for finance brokers. However, not all of these CRMs provide the kind of centralised application centre and dashboard views that you may expect from CRMs such as Salesforce or Hubspot.

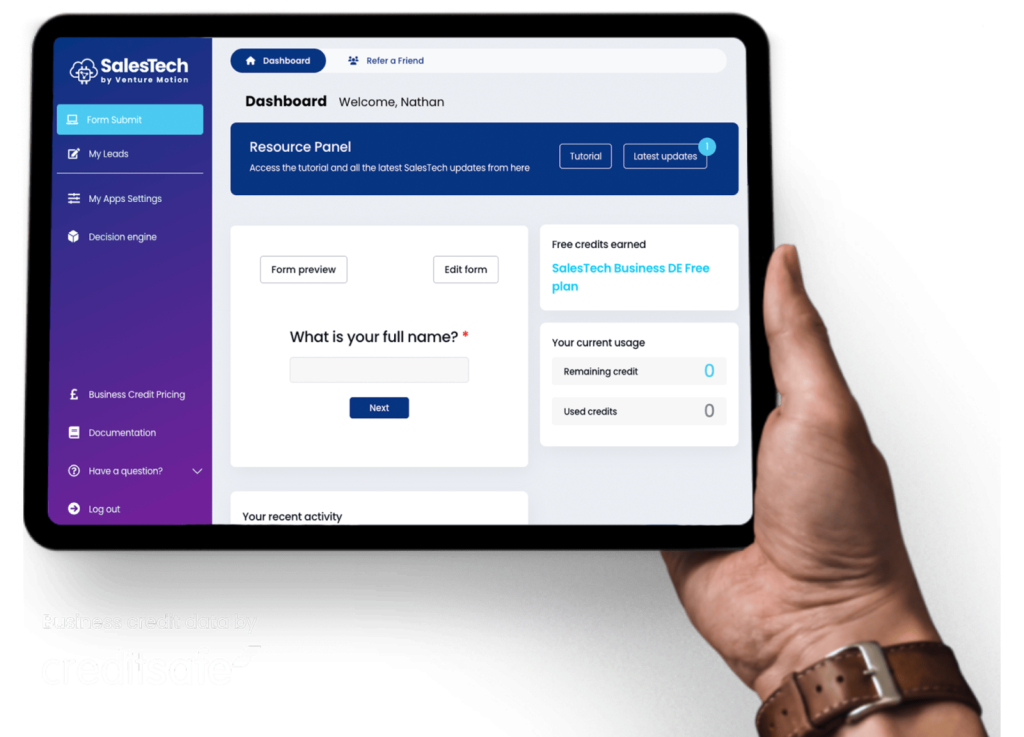

Our finance automation software, SalesTech, is designed with brokers in mind to streamline every aspect of the finance brokerage process.

If you are a business finance broker, you would likely want a CRM focused on commercial finance brokerage to offer: live deal tracking, dashboards, a data collection system and a way to manage and monitor ongoing and completed deals.

A centralised deal tracking system that gives you an overview of all your in-progress business finance deals will allow you to monitor every aspect of the process effectively. A finance brokerage CRM allows you to add deals, and track any approved or declined deals so you can stay fully aware of the business finance process.

A good business finance CRM will provide you with easy-to-use dashboards that you can navigate to easily understand the many different facets of a business finance deal. This includes the above live deal tracking, as well as providing insight into the financial and commercial data used as part of the approval and lender matching processes.

As part of the business finance brokerage process, it’s necessary to collect a wide array of data from potential applicants in order to offer lenders the information required to either approve or decline a loan. This data could include director and shareholder information, bank statement data, CCJs or other legal issues, and more. Whether you utilise embedded forms or manually collect this customer data, a customer data collection hub makes collating and accessing business data far easier and more efficient.

Every lender is different, and every broker works differently. In order to have an effective business finance CRM, it’s essential that a level of customisation is present. From updatable fields that highlight only the information necessary to your processes, to custom forms that you can embed into your website or emails that are automatically filled in within the CRM when the applicant responds.

SalesTech, our commercial finance automation software is a platform built to provide the best possible experience to business finance professionals. The SalesTech decision engine component allows brokers to automate their processes from initial data collection through to pre-packaging deals and matching to lenders.

The SalesTech dashboard is also the ideal platform for finance professionals looking for a business finance CRM with live deal tracking, dashboards, a data collection hub and fully customisable fields.

For more information around how to automate your business finance lending and brokering, get in touch with one of our SalesTech product specialists today.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025