Predictive lead scoring involves taking a data-driven approach to lead scoring and qualification. Using statistical models and historical data, predictive lead scoring assigns a score to inbound leads based on how likely they are to convert to paying customers.

Predictive lead scoring can be very beneficial to businesses in the B2B finance sector. Here’s why it’s important and what separates predictive scoring from more traditional lead scoring methods.

Predictive lead scoring is a method used to prioritise potential customers based on their likelihood to convert into actual customers. As indicated in the name, this method leverages data analysis, machine learning, and predictive modeling to evaluate and score leads, making informed predictions about which leads are most likely to convert.

In the B2B finance industry, ensuring businesses only work with high quality leads is essential to having a profitable and scalable business. It’s an industry reliant on detailed and accurate financial and company information, so ensuring a high quality predictive lead scoring system is in operation is incredibly important.

Predictive lead scoring and traditional lead scoring both aim to prioritise and evaluate leads based on their likelihood to convert into actual customers. However, there are some significant differences in their methodologies and overall effectiveness. Here are the key differences:

Data-driven

Predictive lead scoring takes a more data-driven approach to the scoring process. While traditional lead scoring tends to follow a rules-based system, assigning a score to a lead based on certain actions they take, predictive scoring uses statistical models and algorithms to analyse past trends to identify patterns and assigns a score based on that.

Dynamic

The predictive model can automatically adjust to new information and evolving market conditions, making it more responsive and accurate over time.

Predictive lead scoring models can automatically adjust to new information and changing market conditions over time. This allows predictive lead scoring systems to respond to changes as and when they occur in the often complex and ever changing world of B2B finance.

Increased accuracy

Due to the way in which predictive lead scoring is processed, identifying underlying trends and correlations, it can often be more accurate than traditional methods of lead scoring. By identifying subtle patterns in the behaviour of leads, this method of lead scoring may uncover information about leads that may not be picked up by traditional lead scoring systems.

Complex

One of the drawbacks of implementing a predictive lead scoring system into your qualification and underwriting process is the complexity of these kinds of systems. Whereas traditional lead scoring follows more simplistic, rules-based systems of scoring, the successful implementation and understanding of data-driven, algorithmic scoring systems can be more difficult to achieve.

Lead scoring is an invaluable tool for businesses, especially in the world of B2B finance. However, it is an often long-winded, time-consuming and resource-intensive process. That’s where automation comes in.

We’ve explained the benefits of automated lead qualification at length, and we built SalesTech to help businesses in B2B finance qualify their leads quicker and more efficiently than ever, so they can focus on scaling their business.

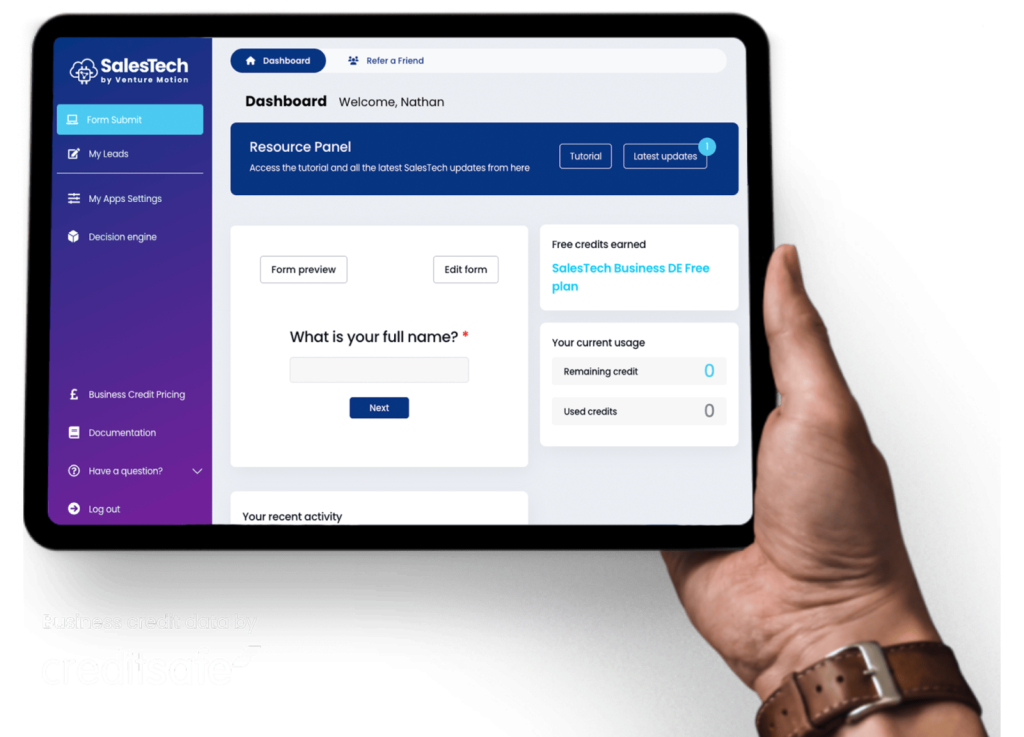

SalesTech is our lead qualification decision engine software that automates the lookup, due diligence, qualification and onboarding process for B2B financial institutions. Combining the data-driven elements of predictive lead scoring with simpler rules-based operations of traditional lead scoring for ease of implementation, set-up and use.

Our software imports, reads, scores and qualifies leads based on data from Creditsafe, company data and any other specific criteria you have. Once qualified, the information is fed into our decision engine, allowing you to approve or deny applicants in seconds.

When you use SalesTech, you establish the criteria necessary to work with a company and we do the rest. Each applicant will be scored against your bespoke requirements and can be automatically approved or denied so you can allocate your time to more efficiently growing your business.

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

Knowing if a company has previously filed for bankruptcy is essential to assessing its financial stability. With Companies House, you can view detailed records of the insolvency history of limited companies which…

© Venture Motion Limited 2025