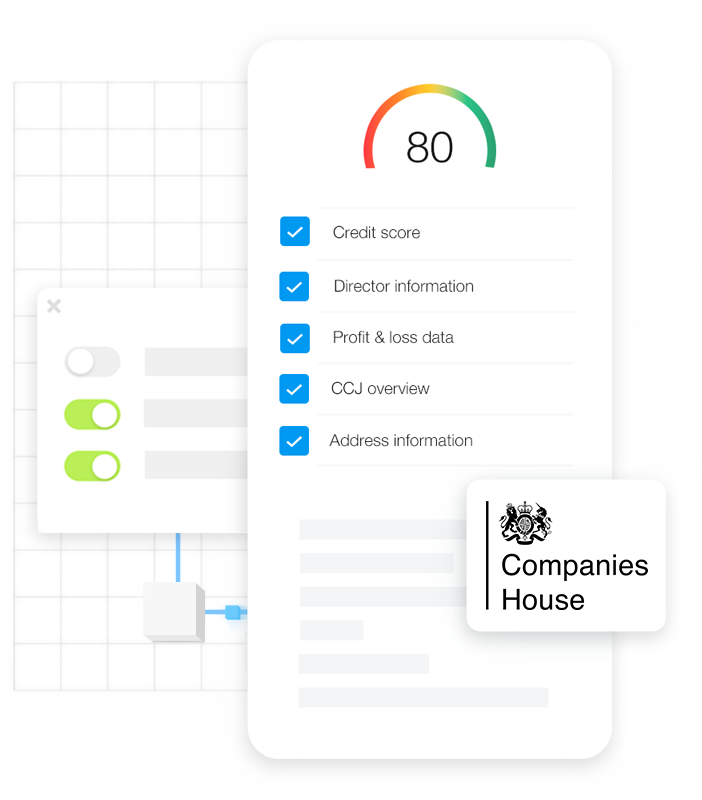

Pre-packaging deals in an instant with automation

Commercial finance is a competitive and continually evolving industry, which is why it’s so important for lenders and brokers to stay ahead of the competition by adopting new technologies. Brokers, in particular, can find themselves easily bogged down when it comes to packaging and qualifying applicants. In order to deliver a highly