Pre-packaging deals in an instant with automation

Commercial finance is a competitive and continually evolving industry, which is why it’s so important for lenders and brokers to stay ahead of the competition by adopting new technologies. Brokers,

SalesTech is our business intelligence and automation platform consisting of a suite of custom built apps that enable organisations in the lending sector to automate their KYC operations and enhance decision making and underwriting.

Whether you’re a business owner, part of a sales or marketing team you’ll find the SalesTech platform easy to use, and incredibly powerful.

With a lending decision engine at the heart of the platform, we enable finance organisations to automate time consuming underwriting tasks whilst aiding sales and marketing with real time data.

SalesTech is an affordable, straightforward business intelligence and automation platform that seamlessly links into your existing processes. Our unique plug-and-play model ensures that – no matter your level of technical expertise – you can experience all of the SalesTech features instantly.

Utilising a range of APIs, our platform automates all of your underwriting and loan application procedures. Giving you the time and money to focus on building your business, while SalesTech sweats the small stuff.

The credit engine technology used in SalesTech is directly integrated with the powerful Creditsafe Connect API. When you use our digital finance automation platform, you’ll have instant, fully automated access to the credit data of over 6 million UK limited and non-limited businesses.

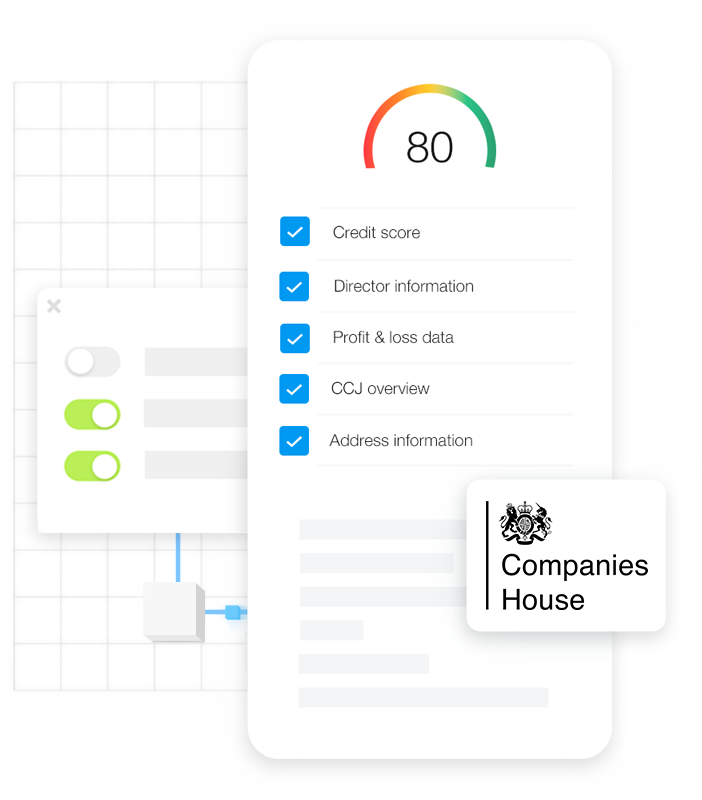

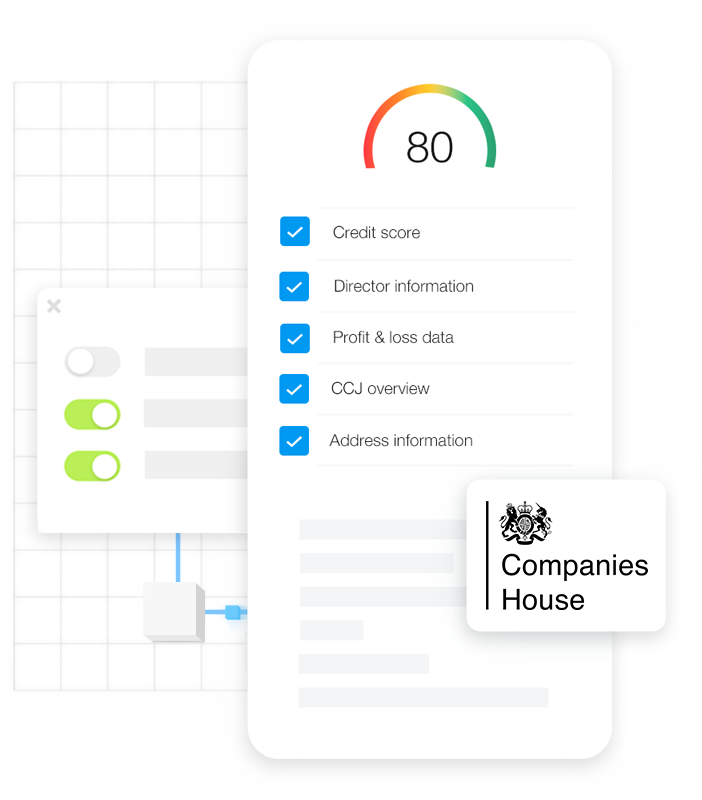

The API gives the platform access to a range of data points to help you make the correct decisions for your business including, but not limited to: Credit and risk score, credit and contract limits, financial data, director and shareholder details.

The SalesTech platform is fully adaptable to the specific needs of your business. Whatever your requirements, our straightforward system will allow you to add and remove data points to build an entirely bespoke business decision engine.

SalesTech is the perfect fit for a range of different sectors within the financial services industry. These include;

Secured business loans

Unsecured business loans

Invoice factoring

Merchant cash advance

Asset lending/finance

Alternative finance lenders

The SalesTech automation platform is built on a foundation of different apps that make

use of both APIs from major credit agencies, as well as custom-built services designed to

benefit any business.

Creditsafe’s business credit API gives our decision engine access to credit data from millions of businesses across the UK.

Our automated decision engine takes data from a number of different sources and makes accurate decisions based on your own custom criteria.

Our fully customisable application form app helps make your KYC process more efficient and feeds your customer data directly into the decision engine.

Risk Score is a metric that assesses a company’s creditworthiness and the likelihood of defaulting on its financial obligations. It is calculated based on various factors in a company’s credit report, such as its credit history, payment behaviour, financial stability, and other credit-related data.

International Score is a measure of a company’s creditworthiness on a global scale. It evaluates a company’s credit risk in the context of the country or region where it operates, taking into account factors such as political stability, economic conditions, and regulatory environment.

Credit Limit is the maximum amount of credit that a company can receive from a lender or supplier. It is based on the company’s creditworthiness, financial stability, payment history, and other credit-related factors that are analysed in its credit report.

Contract Limit is the maximum recommended contract capacity over 12 months. It is often negotiated between the two parties and depends on various factors such as the size of the transaction, creditworthiness of the company, payment terms, and other credit-related data.

DBT stands for Days Beyond Terms and is a measure of a company’s payment behaviour. It represents the average number of days that a company pays its bills beyond the agreed-upon payment terms. A higher DBT indicates a higher risk of default and can affect a company’s creditworthiness. DBT is based on payment data from trade creditors that is included in a company’s credit report.

Industry DBT is an indicator of a company’s payment behaviour compared to its peers in the same industry. It is based on the average number of days that companies in that industry take to pay their bills. Industry DBT is used to identify potential credit risks in a company’s credit report.

Compliance Alerts are notifications that alert a company to potential legal or regulatory issues that could affect its creditworthiness. They are based on data from public records, such as lawsuits, regulatory fines, or other legal actions, which are analysed as part of the company’s credit report.

VAT Number is a unique identifier assigned to companies that are registered for Value Added Tax (VAT) purposes. It is part of a company’s credit report and is used to verify its VAT registration status, as well as to track its VAT payments.

SIC07 Code is a four-digit code that classifies a company’s primary business activity. It is part of a company’s credit report and is used by credit agencies to identify the company’s industry, compare its performance with that of its peers, and assess potential credit risks.

FTSE Index is a stock market index that tracks the performance of the largest companies listed on the London Stock Exchange. It is included in a company’s credit report to provide information about the UK economy and market trends that may affect the company’s creditworthiness.

Share Capital is the total value of a company’s outstanding shares, based on data in its credit report. It is used to calculate various financial ratios and metrics that are used to assess the company’s financial health and creditworthiness.

Commercial finance is a competitive and continually evolving industry, which is why it’s so important for lenders and brokers to stay ahead of the competition by adopting new technologies. Brokers,

In the competitive world of business finance, staying ahead of the curve is key. Whether you’re developing a deep understanding of market trends or effectively performing KYC/KYB analysis, those in

Essential B2B credit solutions your business should be using Worldwide, the B2B payments market is approximately worth a colossal £191 trillion and is only set to grow. With digital payments

The benefits of risk-based decision making Risk. It’s an inescapable factor that must be considered when you operate in the B2B lending, brokerage and wider finance spheres. When it comes

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, cum mediocrem expetendis ne. Dicunt verterem aliquando an

Get started with LendTech today. Start processing hundreds of credit check applications in seconds!

We’ll just a need a few more details to get you setup on LendTech.

We’ve sent you a link to get you started with LendTech to