The rise of alternative finance

Over the past decade, the alternative finance industry has experienced consistent growth, especially among SMEs. Where traditional banks and capital markets once reigned supreme, many of today’s small to medium enterprises – who make up 98% of all British businesses – are seeking more innovative, truly SME-friendly lenders to secure the funding they need.

Since 2008, banks have consistently found themselves less likely to lend to SMEs, giving alternative finance providers a great opportunity to enter the fray. In 2017 alone the alternative financing industry saw a 35% growth, and since then that growth has been on the rise, with experts predicting that it’s only set to keep increasing.

But why is alternative financing booming? For many SMEs, alternative finance providers often offer more innovative and flexible terms than traditional banks. Rather than sticking rigidly to balance sheets and profit margins like the large IP-based and asset-backed banks of old, alternative lenders often look beyond the numbers. By assessing businesses on their individual merits and models, alternative lenders are able to offer bigger loans on better repayment terms to a wider range of businesses.

When it comes to younger businesses in particular, they’re almost five times more likely to seek alternative financing than going to their high street bank. With more and more millennial-run businesses being formed, especially in the wake of the COVID-19 pandemic, a more personalised alternative finance solution will be sought by even more SMEs. Can the lenders keep up with demand?

The power of automation in alternative finance

For many lenders and brokers, one of the primary factors inhibiting growth within the alternative finance industry is the slow adoption cutting edge technology. For many lenders, the main issues holding back the expansion of their service is the sheer amount of tasks they need to perform, leaving them unable to process the number of applications they could be receiving due to a lack of resources or manpower.

This is where automation comes in. Automation in alternative finance eliminates many of the primary issues holding back financial firms from growth. Manual underwriting, assessing applicant bank statement and performing manual credit checks through credit files and Companies House all take up substantial time and resources, and can all be streamlined with the use of automation.

Here are some of our tips for relieving the stress of your alternative lending business.

Take your forms onto the cloud

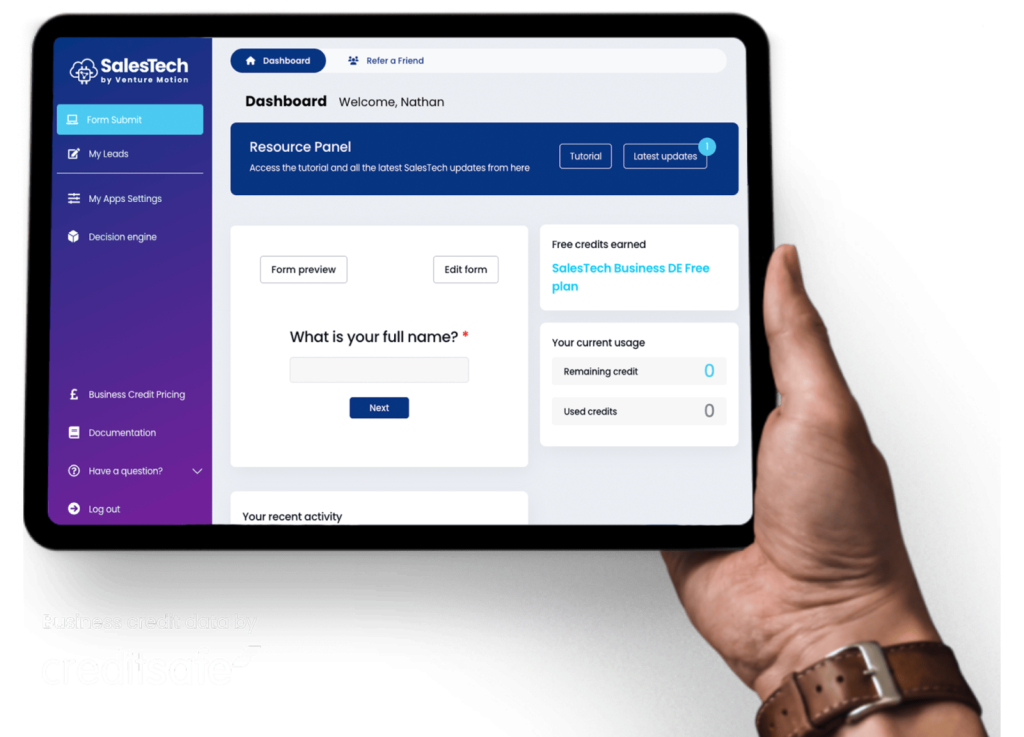

With custom online forms built to your specifications you can begin automating your KYC process from the moment an applicant first applies for funding. Your site may already make use of online forms built and placed using a CMS plugin, but by investing in fully customised cloud-based forms, you can achieve so much more with your forms.

With custom forms you can determine the exact parameters you need to begin the KYC process from the word go. Ensuring all applicant data is securely stored in the cloud – where it can then be processed by the rest of your application process – is also essential for modern alternative finance companies, removing every aspect of the hassle associated with paper applications.

Enhance your applications with external data

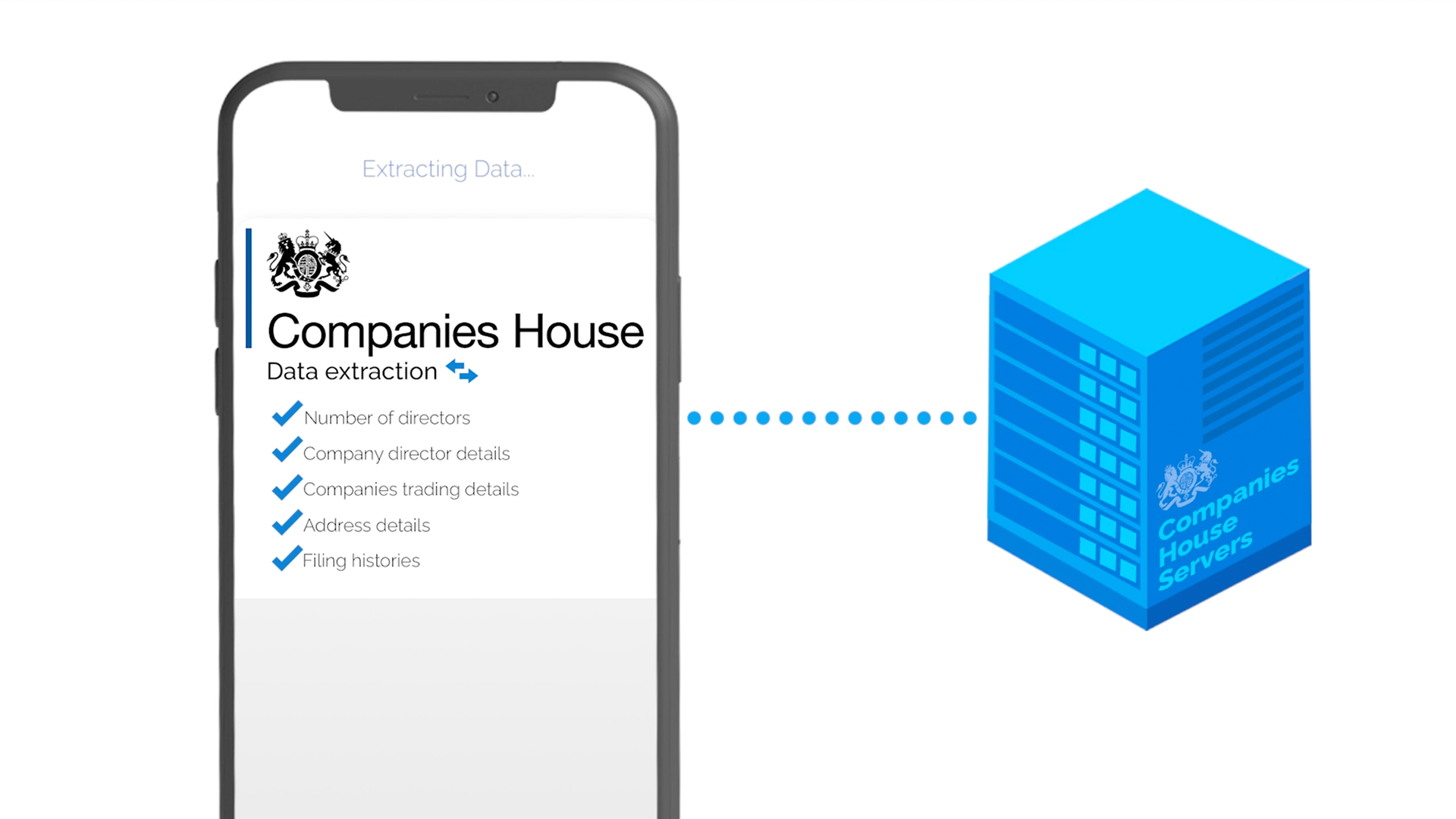

Using automations that pull information from external data sources allows you to enhance, validate and score new clients and applicants before you even need to pass the data onto your underwriting team. Whether you get your data from credit checkers like Experian, Equifax or Creditsafe, or if you offer business loans based on Companies House data, custom automations can benefit your business.

Once the automations are set up, data cross referencing checks can take seconds. You’ll see a dramatic reduction in the time it takes to process applications, cutting out hours of time to ensure your underwriting team can focus on more important tasks.

Use open banking to connect to applicant bank accounts

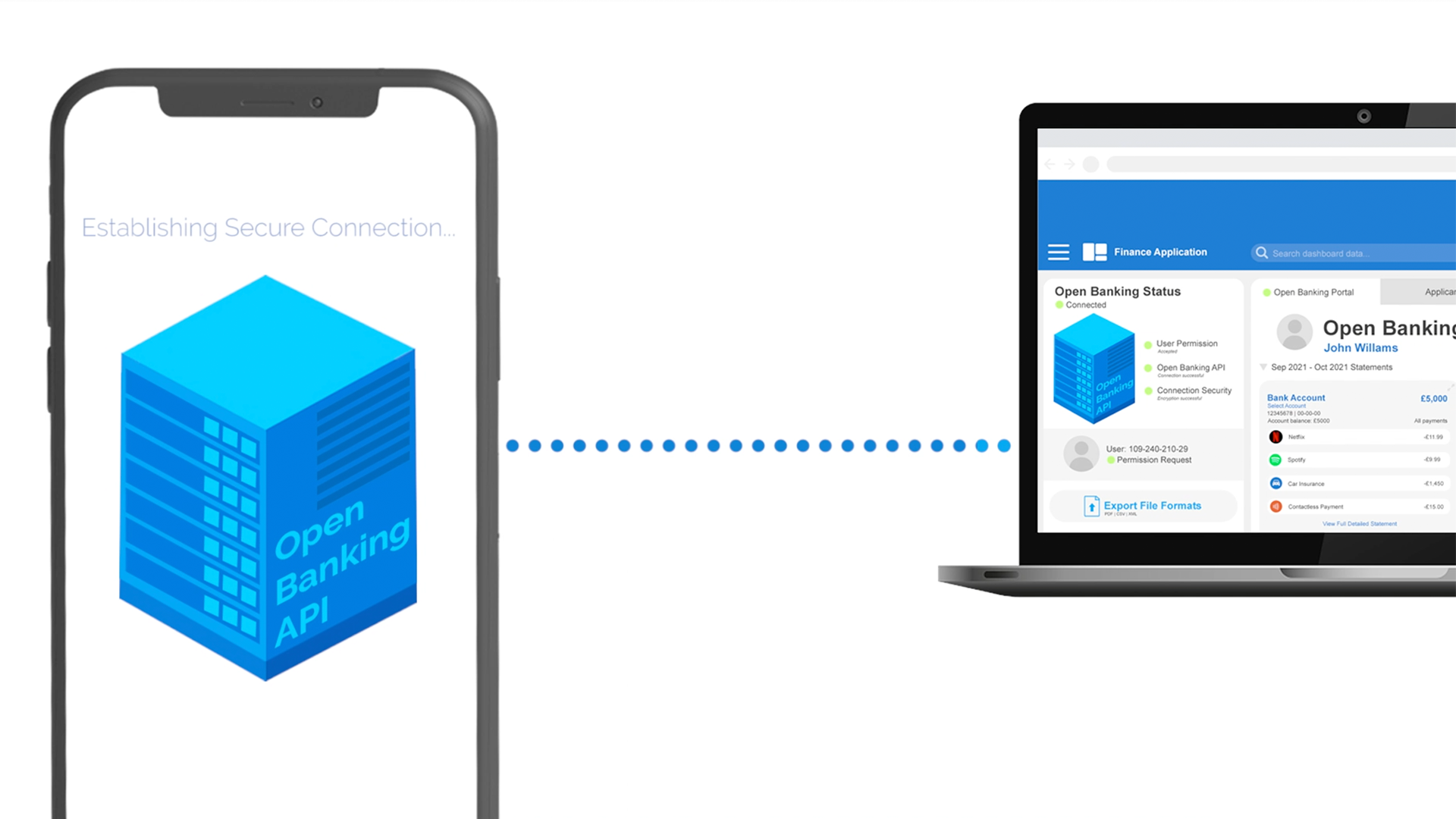

Many alternative finance companies still rely on applicants sending in paper bank statements, to be manually filed on arrival. There are two main issues you’re likely to face if your business relies on the submission of paper statements.

Firstly, the filing process will be time consuming and has a high degree of error. Of course, the time and resources required to manually file hundreds, if not thousands, of submitted documents could cause significant issues if you’re trying to grow your business. Secondly, it is simply not very appealing to potential applicants, who are much more likely to apply if the process for doing so is simplified and digital.

Open banking is, without a doubt, the best solution to this issue. With an open banking API, lending businesses are able to connect directly with a customer’s bank account with next to no effort from either the lender or the applicant. The efficiency of open banking systems also extends to later automations, with customer data available to review remotely, either manually or by an automated system, in real time.

Bring your document uploads into the 21st century

While open banking is great for collecting bank statements, your loan application process may require other documents from applicants. Whether you need applicant ID, proof of address, visas and immigration documents or any other user-supplied document as part of your loan approval process ensuring that you use a cloud-based document upload service will bolster your business.

Rather than accepting physical scans of the necessary applicant documents, open a cloud-based online channel to receive them. You’ll have access to much clearer customer data that can be easily accessed and retrieved whenever necessary. Plus, you’ll have a system poised to seamlessly integrate and automate other aspects of your application system.

Automate the entire decision making process

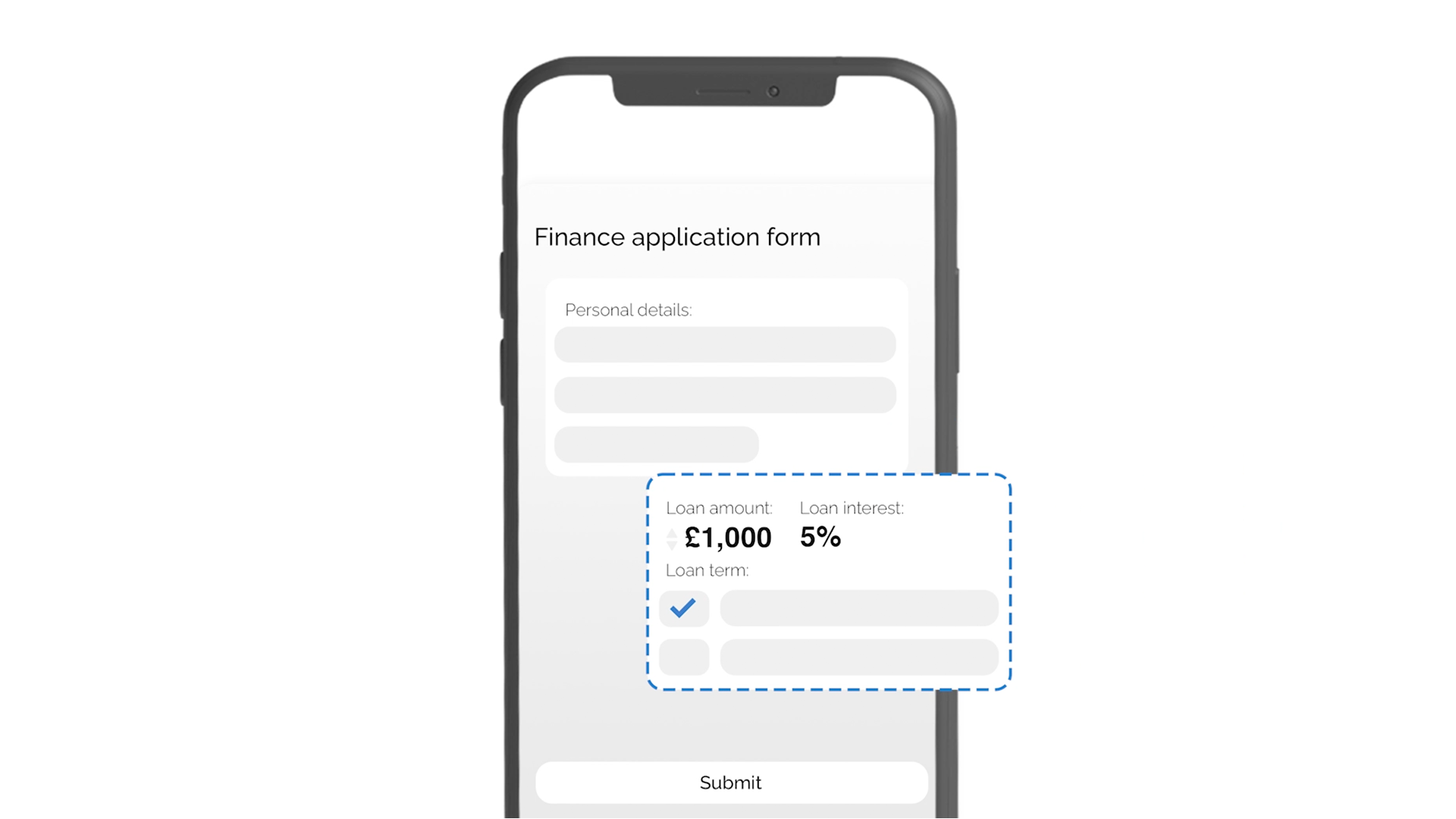

By automating multiple steps in your loan application process, you’ll be able to use advanced automations to all but eliminate the most time consuming aspect of any loan approval – the underwriting. Underwriting is time consuming, often requiring a lot of manpower too.

Utilising automations throughout the application process and feeding customer data into a decision engine means that you’ll be able to automate the entire loan decision process. By using automations bespoke to your business, you can be certain that only the criteria you decide on is assessed, while entirely removing the possibility of human error.

By saving you huge amounts of time, money and resources, automating underwriting and decision making doesn’t just guarantee you a watertight approval system, it also helps your business to grow.

How to automate your alternative finance business

Automations have the capability to save alternative finance companies huge amounts of time and money, opening them up to more opportunities and helping the market to grow even larger. With the finance industry moving into a more digital space across the board, we can expect widespread digitisation and automation within all areas of the lending industry.

To start your journey towards a digital and automated future for your finance business, get in touch with our team today. We offer expert automations for the alternative finance sector, bringing your business into the future.

Looking to automate your finance business?