A guide to digital transformation in the accounting industry

Digital transformation

At its core, digital transformation is simply the process of adopting and implementing technologies into an organisation in an effort to improve traditional processes through digital adoption. The world of digital technology moves forward at a sometimes alarming pace, and it can be easy for businesses to feel like they’re being left behind – particularly in traditional industries like accounting.

Accounting and finance companies make up one of the most prominent industries in the UK. And, with almost every business needing an accountant, having the tools to adapt and assist to the fast pace of growth and technological changes facing everyone in the 21st century is essential. If you’re an accountant, fully transitioning into the digital sphere and keeping up with technological growth (and the competition) means a lot more than simply using Quickbooks.

In this guide, we’ll be highlighting how integrating API-based platforms into your business processes is an essential aspect of digital transformation for businesses in the accounting sector.

Boosting efficiency with digital technology

A key issue facing accountants in the UK and across the world is determining ways to increase the efficiency and effectiveness of their business, without increasing headcount. Establishing efficient accounting processes is essential to giving your business that boost to stay competitive, and there’s no better way to do that than with the introduction of digital technology and automation.

From CRM integration and automated lead qualification, to integration with Companies House data the digital technology you can incorporate into your processes as an accountant is incredible. The impact of implementing this technology can’t be understated, with over 90% of accounting businesses who have increased their use of digital technology believing that it has significantly impacted their business.

Efficiency is at the core of your business’ growth, and by digitally transforming your business with API technology, you can boost your output, without any negative impact on your existing processes. Many APIs simply need some small integration work to be incorporated into your business, meaning you’ll start to see improvements almost instantly.

Companies House integration for accountants

Whether you’re a sole trader or a larger accountancy, having the ability to know your customers’ businesses before taking them on board is essential. There’s no better way to get to know a business than with the data held by Companies House. However, manually going through all of the relevant data can take a lot of time and effort on the part of you or your staff – taking you away from the most important work.

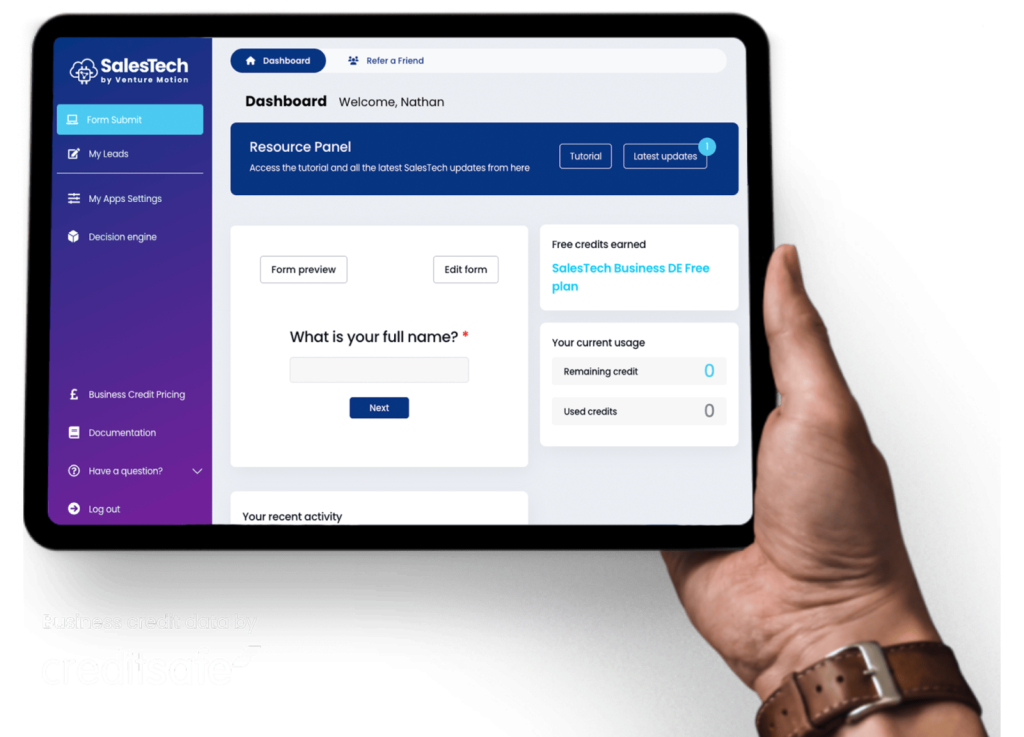

That’s where the Companies House API comes in. Accountancies can integrate the API directly into their existing systems to automatically access whatever data is necessary as part of the KYC process, including officer data, CCJs, filing history and more. Plus, with the API fully integrated, the accountancy is able to enrich their data with the information in real time, ensuring that the data they have on file is always fully updated and accurate.

At Venture Motion, our Companies House Data API also links in with our decision engine technology. This means that even more can be automated, from the very start of the KYC process, to automatically qualifying any leads against the criteria you choose. In no time at all, you’ll have a far more efficient business, with no increase to headcount.

To find out more about how our integration and automation technologies can help your accountancy business, get in touch with our expert team today.