A step-by-step guide to checking the creditworthiness of a company

Creditworthiness is key when it comes to offering financial services to businesses. From determining a business’ level of financial stability and ability to repay loans, to understanding how they operate, assessing creditworthiness is a core aspect of due diligence before taking on a business client.

What is company creditworthiness?

Company creditworthiness refers to an assessment of a company’s ability to meet its financial obligations, particularly its ability to repay loans, fulfil contractual agreements, and manage its financial commitments responsibly. Creditworthiness is a measure of the company’s financial stability, reliability, and overall credit risk.

There’s a lot riding on creditworthiness, so knowing how to check the creditworthiness of a company is essential. We’ve put together a step-by-step guide to determining company creditworthiness to ensure you make the right choice when onboarding your next business customer.

A step-by-step guide to determining the creditworthiness of a company

1. Gather Basic Information

The first step in assessing the creditworthiness of a company is to ensure that you have the very basic information about them available to you. Though very simple, the essential details of the business are essential to assessing creditworthiness. This includes: the registered name, physical address and legal structure (e.g. whether they are a limited company, an LLP, etc.)

This basic information can help you determine the legitimacy of the business and is a key aspect to complete before proceeding.

2. Assess Financial Health With Companies House Data

Once you have the basic information on the business whose creditworthiness you are checking, the next step is to use the data held by Companies House to accelerate the process.

Companies House data will allow you to see director information, if there are any unpaid debts or CCJs against the company, whether the company is in administration and more general filing histories and financial statements that you can analyse later.

Some of the information available through Companies House can show you very serious red flags when it comes to creditworthiness assessments. CCJs in particular can indicate that the business has had serious financial issues and a history of non-compliance.

3. Run A Business Credit Check

Once the company has passed your Companies House checks, it’s time to run a business credit check on them. While Companies House offers a range of very beneficial public information, by running a business credit check against a company, your creditworthiness assessment will be even more accurate.

A business credit check from a trusted provider like Creditsafe is invaluable when assessing creditworthiness. A business credit check will give you even deeper insight into the financial stability of a business, showcasing a company’s in-depth credit history, as well as providing you with a credit score similar to that of a personal credit report.

Many credit report providers will also offer you a suggested credit limit for your business clients. This enhances your creditworthiness assessment even more, and ensures that you are undertaking more advanced due diligence.

4. Analyse Financial Statements

Once you have successfully run a credit check on a business, you can comfortably analyse their financial statements. With a business’ balance sheets, profit and loss statements, and cash flow statements you’ll have much deeper insight into their financial health.

Take financial ratios, liquidity and profitability into account and you should find it relatively straightforward to understand how the company manages debt. From there, you’ll be much closer to accurately determining their creditworthiness.

5. Verify Trade References

With all the information so far, you should have a solid grasp on the creditworthiness of the company you are assessing.

However, another very useful avenue to pursue as part of the process is verifying trader references. Contact the business’ suppliers and trade partners to request references regarding their own experiences with the company being assessed to accurately verify their experiences.

Verifying a business’ legitimacy and creditworthiness independently through people who have worked with the business gives you very reliable and accurate information into how reliable the company really is.

A faster way to check creditworthiness

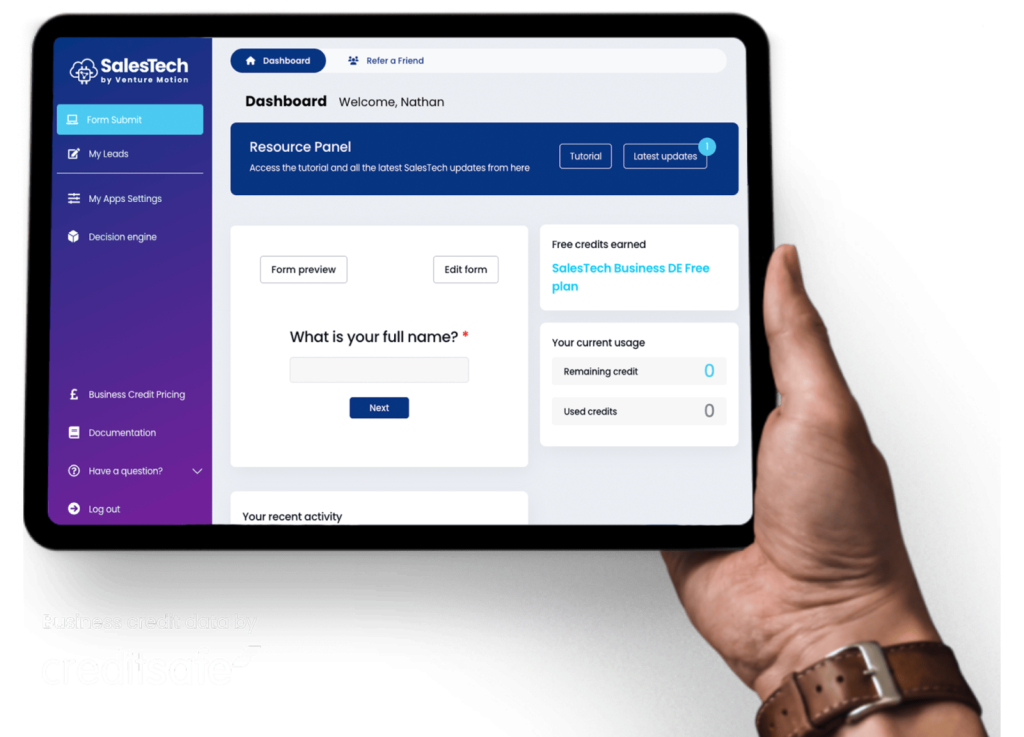

Creditworthiness is an important step in the onboarding process, but it can be time consuming and resource intensive. When both speed and accuracy are key, having an advanced automated business intelligence platform on your side can be a lifesaver, which is why we build SalesTech.

With SalesTech, you’ll have full access to all of the data available from Companies House and the ability to credit check businesses, all in the same place. Based on your custom criteria, our platform will automatically create reports, enriching your data and ensuring you spend your time and resources only where they are most important. SalesTech can even automatically approve or decline applicants for your services based on creditworthiness parameters that you define.

For more information about our SalesTech platform, get in touch with our team today.