AI and business finance: How it affects you

AI in finance is a growing trend, wherein artificial intelligence and machine learning technologies are able to mimic the decision making skills of humans to enhance the workings of financial institutions and businesses.

The rapid growth of AI technologies is hugely important for businesses in all sectors, but particularly in finance. As with most other industries, the ability to adopt AI and to adapt your business to scale from it will ensure that you can futureproof the work you do, while keeping ahead of the competition. In this article we’ll be looking into what exactly the relationship between AI and business finance is going to be in the near future, and how you can become an early adopter to make it work for you.

AI and machine learning in business finance

The business finance sector is one of the industries set to be most heavily impacted by the growth of AI and machine learning. Two of the most prominent problems faced by business finance companies are the issues of the time taken to complete processes, and the human error that may have a detrimental effect on the work being undertaken.

With AI, any fears of processes taking longer than necessary or being performed incorrectly are eliminated. Whether in credit decisioning, risk management or fraud prevention, a great artificial intelligence can provide businesses with a far superior outcome.

In terms of credit decisioning, using AI technology to automate the credit scoring process can be very valuable. In utilising APIs from top credit checking companies such as Creditsafe or Equifax, AI technology can assess any applicant based on criteria set by a lender or finance broker to make underwriting decisions in a matter of seconds. With highly sophisticated rules systems, lenders can use AI to assess applicants far quicker and more accurately than they could with manual checks.

When risk management and fraud prevention are bolstered with AI, they become far more powerful. The complex cognitive computing systems that form the backbone of AI mean that the analysis of real-time trends and activities of financial markets, organisations, environments or individuals are faster and more accurate. With AI, businesses can create situations in which risks are highlighted early, and fraud detection systems can catch and prevent fraud before it happens.

AI and lending go hand in hand

The lending industry, in particular, could be set to be revolutionised by the introduction of AI technology. As mentioned before, AI is a revolutionary tool when it comes to credit decisioning. However, many of today’s AI lending platforms take the great results of AI tech even further, allowing lenders, brokers and other finance professionals to automate their entire processes with AI and machine learning.

For instance, with an AI-enhanced lending process, a business finance company could automate their entire underwriting process with only minor human input. This allows businesses to increase the speed through which deals, applications and qualifications are processed, drastically reducing the time spent without losing any of the quality. Speed aside, this would also free up the underwriting team from time and resource incentive work, allowing them to focus on areas to directly grow the business.

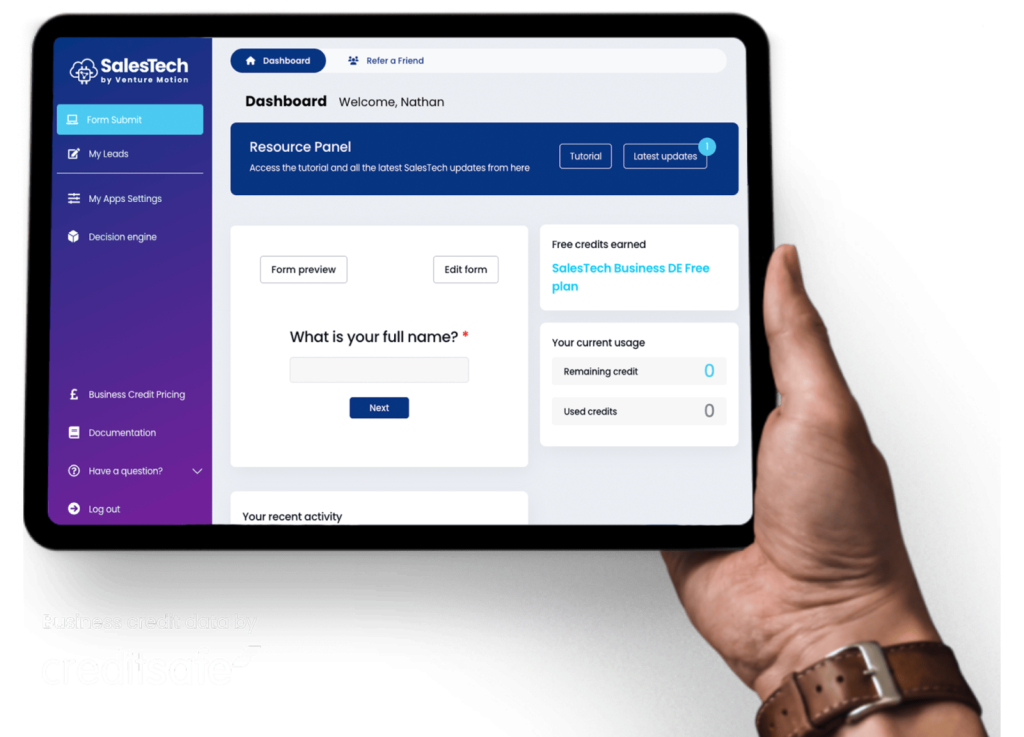

AI-driven lending platforms

With the growing prominence and importance of AI in business finance, it’s never been easier for business owners to get started with integrating AI into their own processes. With platforms like our own LendTech Decision Engine, business finance companies can have the full power of AI-powered decision making and automation with no experience required.

Automation platforms like this are designed to assist financial businesses with the most time intensive aspects of their business so that business owners can spend time doing what matters: building a great business. Whether automating credit checking, onboarding, the KYC process or any aspect of underwriting, an AI-driven lending platform could be the next step for your business.

To find out more about what LendTech could do for your business, get in touch with the Venture Motion team for a free demo.