Enhancing Tenant Credit Checks With Automations

As a landlord, understanding all of the options available to you when it comes to credit checking a prospective tenant is incredibly important. But, for years, a fast, reliable and affordable tenant credit checking platform was almost impossible to find. There is hope however, with the best tenant credit checks for landlords and letting agents now taking the form of fully automated systems. But how are automations used within the letting sector? And, more importantly, are they accessible and affordable? In this article, we’ll be taking a look at how automations are giving a big boost to anyone looking to credit check a prospective tenant.

What is automated credit checking?

Credit checking prospective tenants is an essential aspect of business for a range of letting agencies and landlords. But it can be a time consuming process, especially if you’re setting up every check individually.

Automated credit checks do pretty much what they say on the tin; automation of the credit checking process. They allow landlords and letting agents to learn all the information they need to approve a tenant in seconds, without having to do any of the hard work themselves. Once integrated into the business, it’s simply a case of letting the automations do their thing while new, credit-checked tenants come rolling in.

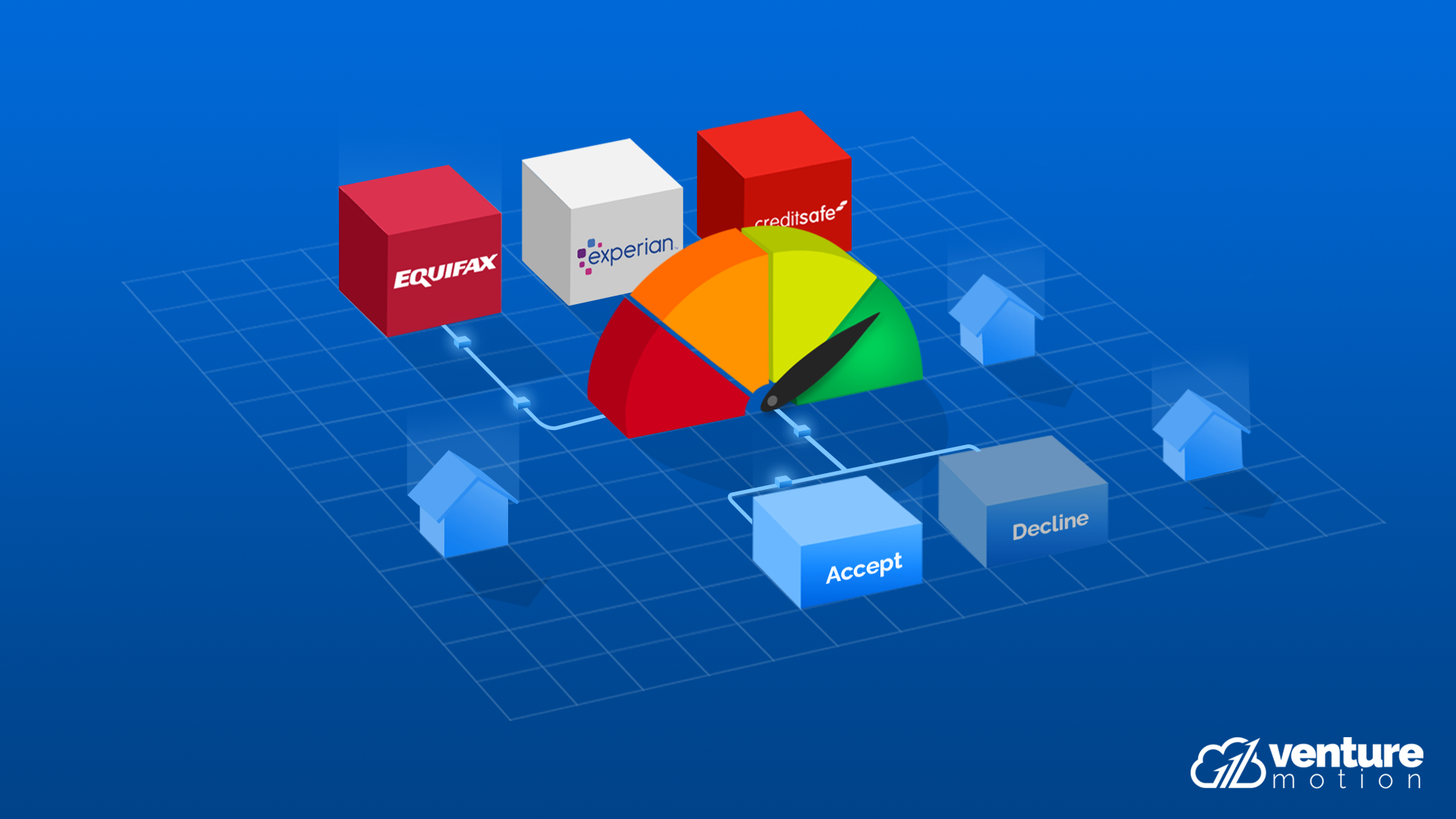

With automated credit checking, however, landlords have access to the best tenant credit check tools on the market. Many landlords and letting agencies are already using the likes of Experian or Equifax to perform tenant credit checks and the best thing is that automated credit checking platforms make use of these too, so the person doing the checking doesn’t have to worry about changing their existing processes when they upgrade into automations.

Why use automated credit checks for tenants?

How to automate tenant credit checking

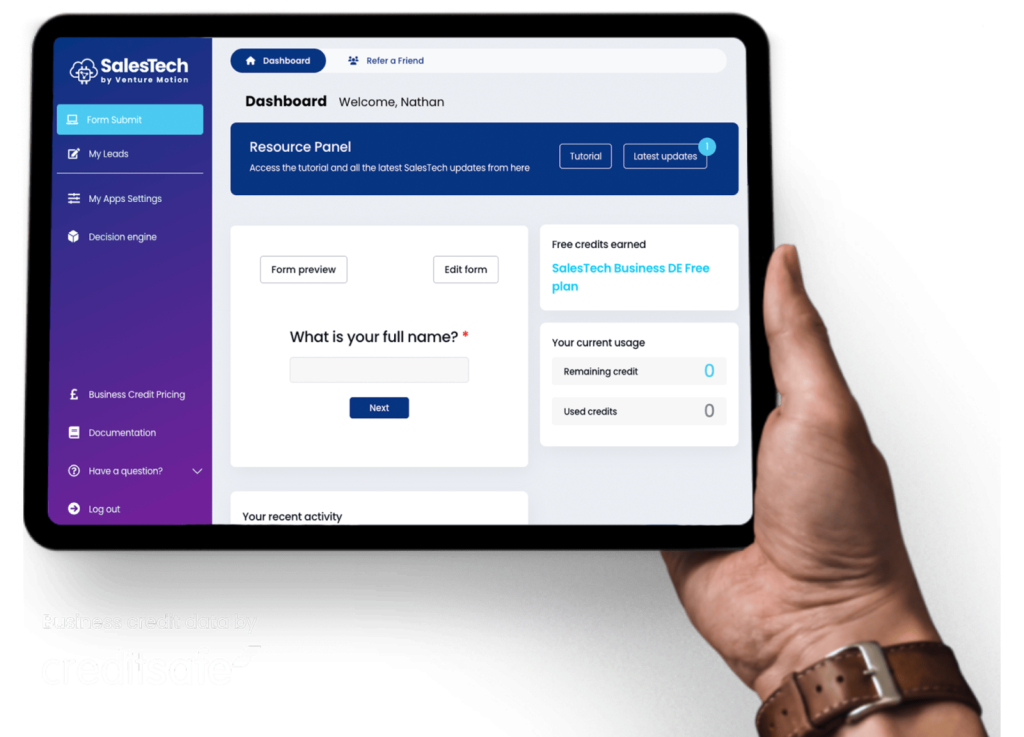

Most automated credit checks involve the use of an API that integrates into your existing systems, making it pretty seamless to upgrade to the best tenant credit checking method out there. In the case of our own automated applicant decision engine, LendTech, the installation process is almost instantaneous.

Once you have access to the LendTech platform, you have access to our easy-to-use dashboard, from which you can see the status of any application. You can even go beyond basic credit checks, utilising custom application forms and open banking technology to get an even more in-depth insight into the tenants. Plus, this information is fed into our decision engine, which allows you to automatically approve or deny just about any tenant application automatically.

For more information on how automation can help you with your prospective tenant credit checks, fill in the form below and start building your solution.