B2B is, all-too-often, a difficult sector to work in. But this is especially so, when you’re offering financial services to other businesses. From ensuring all of the information you have on other companies is correct and up-to-date, to underwriting and approving loan or finance applications, it’s rarely a straightforward process.

Believe it or not, there’s a tool out there that can simplify the whole process: the Companies House Data API. Offered by Companies House themselves, the API can be integrated into your business’ systems, giving you immediate access to all the data Companies House has to offer.

But what data is available through the API, and how can it benefit your business? In this article, we outline exactly what the Companies House API can do for you and the many ways it can totally revolutionise your business. All you have to do is make sure that it’s expertly integrated into your existing systems.

What data does the Companies House API provide?

The public information available through the Companies House API is valued at over three billion pounds, so it should come as no surprise that the data available to you once you’re using the API is incredibly wide-ranging. The full list of data available can be found the Companies House website but, in summary, the main areas of data you can access through the API are:

- Company information data

- Company filing data

- Insolvency cases data

- Charges data

- Officers data

- PSC data

Within each of those categories, there are even more subcategories, ensuring that there’ll be data that you can utilise in some way. No matter what your business offers, having on-the-fly access to Companies House data through the API is guaranteed to benefit the running of your business.

How Companies House data can benefit your business

With access to the wide range of useful data that the Companies House API offers, your KYC process can be dramatically enhanced. With billions of pounds worth of company data just a click away and fully accessible in real-time, you can make decisions in regards to other companies far more efficiently.

The kind of data available through the Companies House API often underpins lending decisions, meaning that the time taken for the underwriting process can be rapidly accelerated. Within seconds, you’ll be able to make decisions based entirely on up-to-date, accurate information.

The Companies House API lets you go one step further, however. Once you’ve started using it, we can link the solution into our LendTech Decision Engine, bringing even more benefits to your business offerings.

How the Companies House API integrates with the LendTech Decision Engine

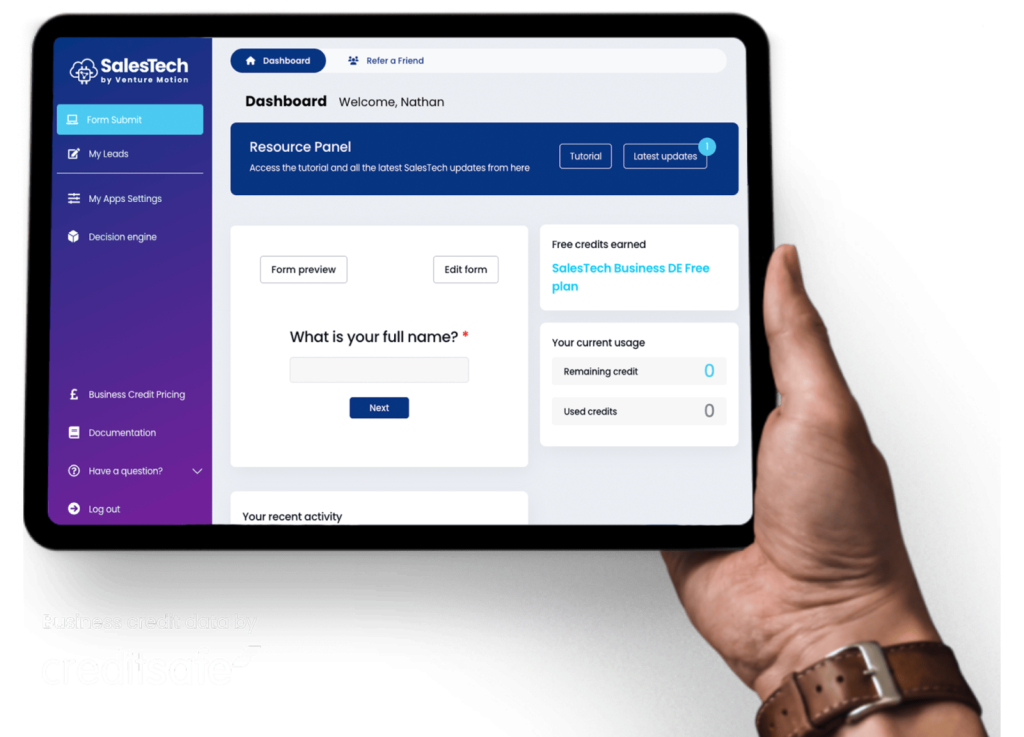

As a part of our LendTech suite of solutions, when we integrate the Companies House API into a business’ internal systems, we always aim to integrate it into our Decision Engine too. In doing so, we allow our clients to really make the most of the API’s power, entirely eliminating the usual time and effort required when underwriting B2B customers.

Once integrated with our LendTech Decision Engine, the Companies House API really comes into its own. Utilising the same data you have access too with the standalone API, our Decision Engine processes the data based on your custom criteria, scoring, approving or rejecting applicants in seconds.

You decide the criteria required. Whether you want to retain manual approvals only for those customers who hit a minimum score based on your requirements, or if you want to hand full approval power over to the Decision Engine, the choice is yours. However you decide to utilise it, once you integrate the Companies House API with the LendTech Decision Engine, your entire B2B offering will be upgraded to entirely new heights.

To unlock the potential of the Companies House API in your business, start building your solution today.