How to check business credit references

Gross lending for UK businesses is projected to reach almost £500 billion in the 2023 financial year. With so much capital at stake, it’s incredibly important for business lenders, brokers and others in the business finance landscape to have access to up-to-date and accurate information on the financial history of their business clients.

At Venture Motion, we deliver game-changing solutions to allow our customers to check business credit references and automate their KYC and KYB process.

Do businesses have credit scores?

Credit forms the backbone of the business economy, allowing individuals and businesses to borrow money and access services on the proviso that they will pay it back at a later date. Simply put, credit scores are used to assess whether a business or individual has the capability to pay back the loan they have taken out.

Much like individuals, businesses have credit scores used by banks, lenders, brokers and investors to make lending decisions. The creditworthiness of businesses is an essential part of the underwriting and pre-approval processes, so having access to, and understanding, business credit scores is incredibly important to anyone in the business lending industry.

What is contained in a business credit score?

Much like a personal credit score, a business credit score is determined by a number of factors. Unlike most personal credit scores that range from 0 to 999, the majority of business credit scores – including the score provided by our partners at Creditsafe – range from 0 to 100. As with a personal score, the higher the number the more stable, secure and, ultimately, creditworthy the business is.

The most basic features of a company credit score include the age of the credit history, the number of recent credit enquiries made by the company and the company’s payment history. These are the same factors that your personal score is likely made up of, but when it comes to business credit, there’s a lot of other factors you need to consider. It’s these additional factors that make reading and understanding business credit references so important for business finance professionals.

When you check a business’ credit report, you’ll not only be aware of the company’s financial health, but also information about the business such as the business’ name, incorporation date, trading address, SIC code and more.

The credit references you can check through business credit agencies also help you make the fundamental decisions around company credit limits. With the credit reports from Creditsafe, in particular, you will be provided with a recommended credit limit to act as a rough guideline on the maximum contract capacity on a single contract over a 12-month period. You might refer to this as trade credit, and with it you can give your customers the power to purchase goods and services without them having to apply for a traditional loan.

Checking business credit references

Accessing business credit references is of the utmost importance to anyone operating in the business finance space. From lenders to brokers to investors and beyond, business credit scores are an essential part of the qualification and underwriting process.

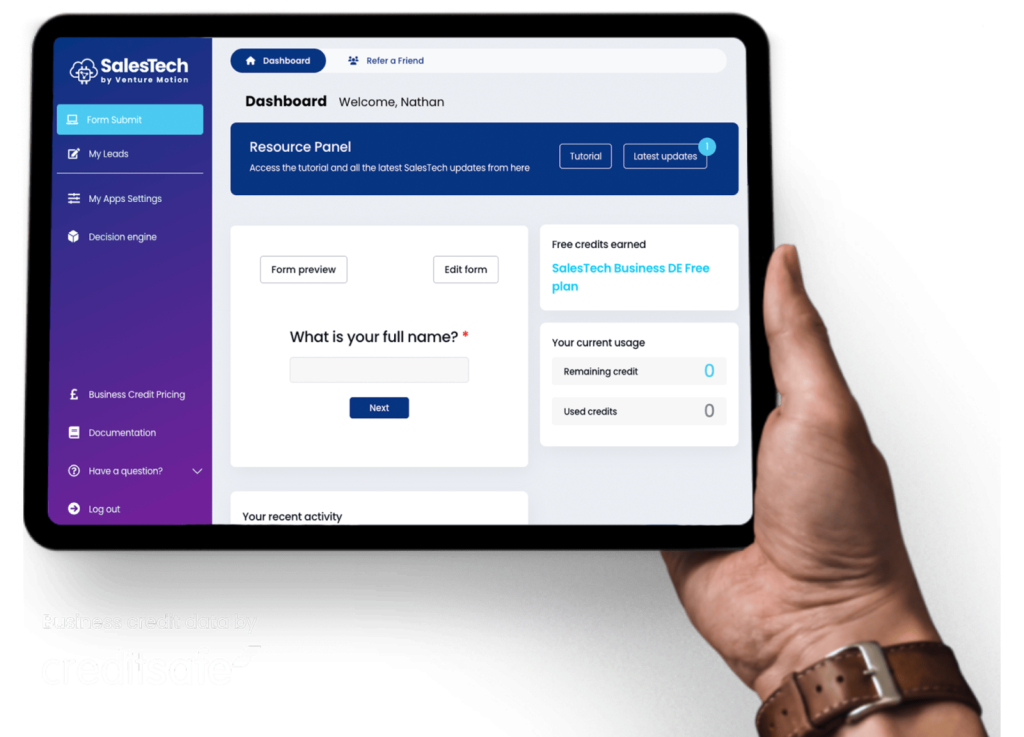

However, with the importance of business credit checks many of the organisations we work with find themselves spending far too much time on the credit checking aspect of their approval process. That’s where our SalesTech platform comes in.

We have developed a platform that automates the entire company credit checking process, streamlining applications and cutting down the approval time to seconds. When linked in with our unique AI-driven Decision Engine technology, our platform will import, read, score and qualify Creditsafe business credit reports based on a set of criteria that you determine.

If you need help checking business credit references and enhancing your qualification and underwriting processes, book a call with our team today.