SME lenders are revolutionising business finance with automations

In 2021, the number of SMEs operating in the UK plummeted to its lowest level since 2015. This was, of course, a direct result of the Covid-19 pandemic and now, more than ever, UK businesses are in dire need of financial support.

While it was active, the government’s Coronavirus Loan Scheme provided almost £80 billion of loans to over one and a half million UK businesses. With the wholesale and retail sector receiving the highest proportion of these loans. This scheme is now over, and as we emerge on the other side of the pandemic, more and more SMEs will be seeking loans to help kick start their businesses.

We live in a digital age that has only been accelerated since 2020, with more and more businesses and consumers looking to new, innovative, online resources to suit their needs. As with almost all aspects of business in 2022, SME lending is changing too, with more and more options for businesses outside of traditional banks. Here’s how digital-first fintech is on track to disrupt the SME lending landscape and provide UK SMEs with a better, simpler way to finance their business goals.

SMEs borrow less than you think

Research from the Bank of England in 2020 showed that of the business owners that consider a loan, 60% choose to use their personal funds to finance their venture. On top of that, of those businesses that took out a loan, 50% went with the first provider they considered.

With the majority of SMEs set up on the back of personal funds, it is likely that a substantial number of businesses never get off the ground, purely because they don’t want to apply for a loan. With more than a quarter of business owners saying that they are put off by the hassle of applying, something needs to change.

The Bank of England’s data highlights a very important issue that alternative SME lenders should consider: many business owners are put off by the difficulty of applying for a loan, and if they do apply, it’ll almost always be with a big bank they trust. In fact, non-bank lending only makes up 16% of all business loans in the UK.

With such a reliance on established high street banks customers are, more often than not, faced with long-winded and complex application processes. As such, there is a gap in the market for forward thinking SME lenders to utilise cutting edge fintech platforms to eliminate the hassle that goes into the business loan application process.

How SME lending technology will change the game

Writing for Finextra, Francois Levy highlighted that traditional banks had struggled to service the lending needs of SMEs even before Covid. This was only exacerbated by the introduction of the aforementioned government loans, with many banks prioritising their own customers. This left many SMEs in the lurch, struggling to find a lender that could provide loans quickly and effortlessly to help them bounce back from the pandemic, or even give their burgeoning business the cash injection it needed to start.

Fortunately, in many cases, there are ways for business owners to acquire financing in a far quicker and simpler manner. Today there are a range of fintech SME lending platforms out there designed to provide the best service possible for lenders and borrowers. Two of the most important fintech products available in this space are business credit checking platforms and open banking technology.

Business credit checking platforms

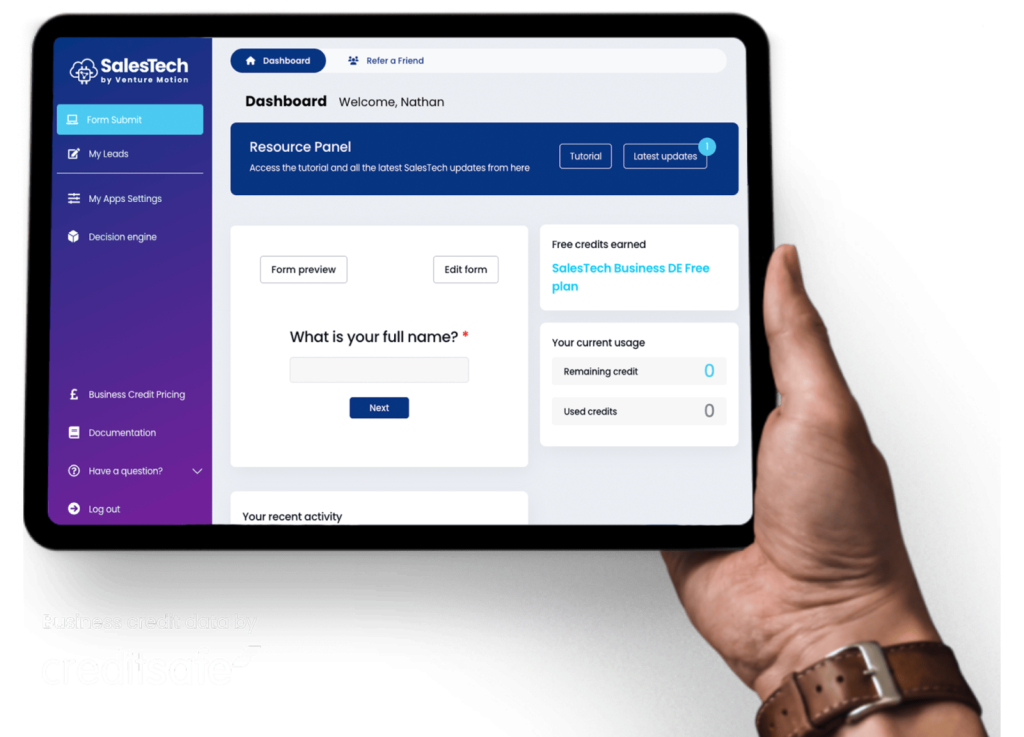

Many of the largest company credit check providers offer APIs that can be seamlessly worked into an SME lender’s existing processes to offer instantaneous credit checking capabilities. With nothing but a simple form-fill from the potential borrower, the result of a credit check from the likes of Creditsafe, Equifax or Experian can be pulled through instantly.

Rather than rifling through reams of paperwork and the financial history of every applicant manually, the APIs will automatically use the data from some of the world’s largest credit agencies. Having the ability to check businesses with this technology allows every SME lender to more efficiently distribute their time spent on a loan application.

Open banking technology

Similarly to business credit checking APIs, open banking APIs can be seamlessly integrated into a lender’s processes to gain a comprehensive understanding of an applicant’s financial history. Open banking platforms link into the bank statements of applicants, giving you the ability to view bank statements digitally in real time.

Lending decision engines

To make the loan approval process even more efficient, credit checking APIs and open banking technology can be combined and cross-referenced. The open banking data and credit check results can then be automatically entered into a lending decision engine that will streamline the entire application process.

Decision engines like our own LendTech platform utilise custom criteria set by the lender, combined with the results of the credit check, to approve or deny a loan in principle in seconds. Not only does this save the lender time and effort, but it also allows borrowers to apply for loans more quickly than ever before, with instant results that improve the entire borrowing experience.

The future of SME lending

As SMEs continue to bounce back after the pandemic with a more digital mindset, it is only more likely that we will see a rise in alternative lending solutions. Traditional banks will likely adapt in time, but it is up to smaller SME lenders to set the standard for business loans to come.

We hope to see a continued growth in the use of new developments in the fintech lending space that will allow innovative small businesses to thrive, without business owners having to rely on their own capital or the traditional high street banks.

For more information on how you can bolster your SME lending business with cutting edge automation technologies, get in touch today.