Who are the top credit checking agencies in the UK?

Credit checking is perhaps the most prominent aspect of the modern lending industry. Accessing and reading credit scores is an essential part of the underwriting process for lenders in all sectors. Whether B2B or B2C, having instant access to accurate credit information is extremely important.

Whether lending is the primary driver of your business, or just a small component of your wider business offering, knowing where to go to credit check your customers is incredibly important. In this article, we’ll look into who the best credit checking agencies are for both business and consumer and business credit reports, and how they can fit into your processes.

Creditsafe

Creditsafe is an Ireland-based provider of company credit scores and other credit data. The company is the world’s most widely used provider of online company credit reports and an essential resource for organisations looking to offer business loans.

As one of the world leaders in the provision of company credit data, we chose Creditsafe to power our own company credit decision engine, LendTech. With the CreditSafe API, we’re able to check company credit data in real time, dramatically boosting your underwriting capabilities. With a great well of business credit data to pull from, Creditsafe is an almost essential resource for business lenders.

TransUnion

TransUnion is a leading provider of credit information based in the US. Offering a wide range of services including credit reports, credit scores and a myriad of other credit data and information, TransUnion’s data is used by organisations around the world.

The company’s vast data resources, analytic capabilities and real time access to credit information make it an incredibly powerful tool for anyone looking to make accurate, informed credit decisions.

Experian

Headquartered in the UK, Experian is a leading provider of credit information and analytics across the globe. With a wide range of credit data at their disposal, Experian is a useful source for lenders, insurers and other businesses looking to perform both personal and business credit checks. Experian provides organisations with detailed information on the creditworthiness of people around the world. As such, it’s a very useful tool for businesses everywhere.

Equifax

Based in the USA, Equifax is a renowned provider of global credit information and analytics. Boasting a range of data, it’s a go-to source for all types of businesses looking to conduct credit checks on personal and commercial clients. Providing in-depth insights into a variety of credit information, it’s a highly valuable tool.

Automating credit checking

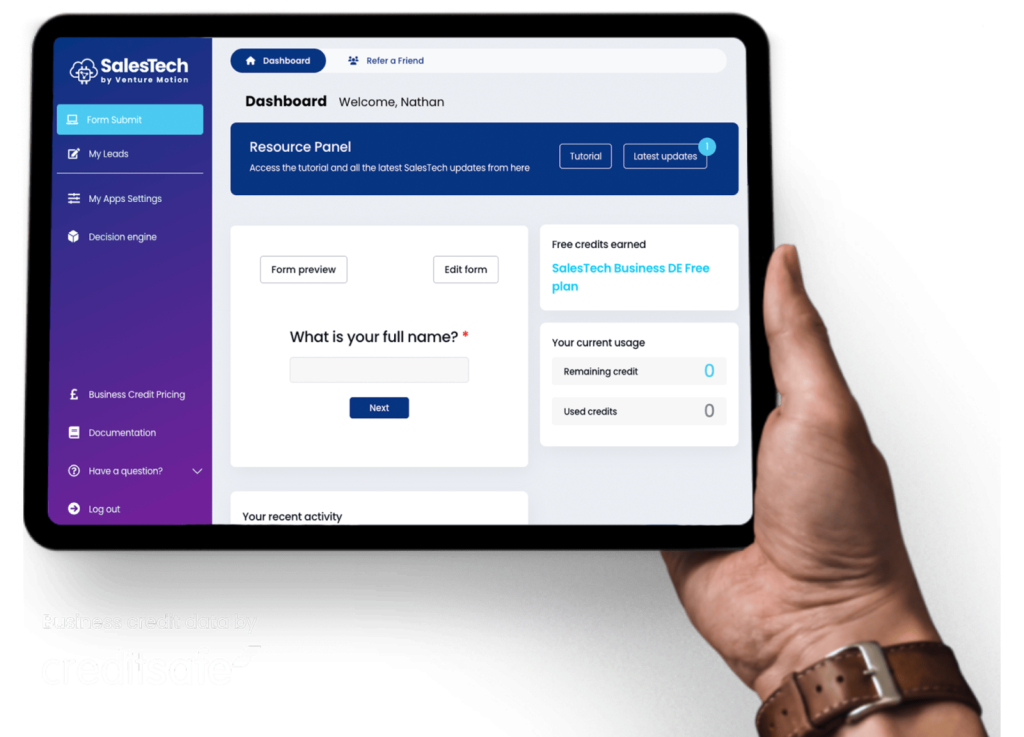

At Venture Motion, we understand the importance of credit checking for businesses of all sizes. Our state-of-the-art LendTech Decision Engine is powered by CreditSafe and uses advanced algorithms to analyse the credit data of your customers in real time, making creditworthiness decisions instantly.

Meanwhile, we utilise data from multiple credit agencies in our custom development work to build credit decisioning technology that fits your business needs perfectly. So whatever industry you’re in, if automating and streamlining your credit checking process would benefit your business, get in touch with us today and see what we can do for you using the form below.