Why automation is the future of mortgage underwriting

In the mid-19th century, the UK’s very first building societies were formed, and with them came the modern mortgage as we know them today. For years, the mortgage industry relied on manual underwriting to approve people looking for mortgages, with brokers up and down the country spending hours upon hours on researching the financial risk that an applicant would be when applying for a loan.

In recent years, however, mortgage application automation software has become more and more popular, with industry experts believing that it is having one of the biggest impacts on the entire mortgage brokerage landscape. With almost every big bank and building society out there using automated underwriting, many smaller brokers are starting to feel cut out and irrelevant. However, if brokers make use of automations themselves, they’ll be futureproofing their mortgage brokering business.

Why automation is the future of mortgage underwriting

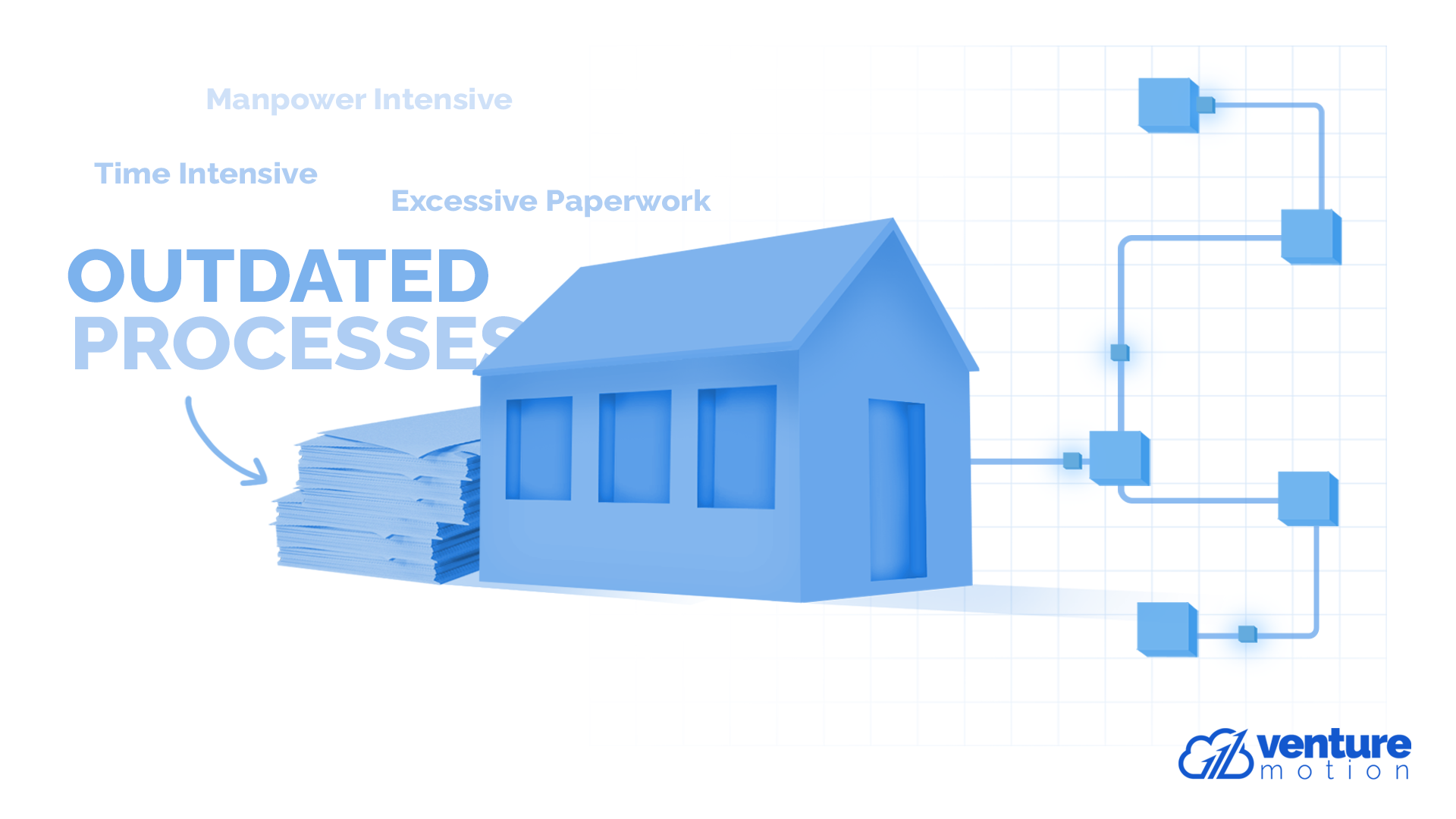

Traditional mortgage applications are full of excessive paperwork, making manual underwriting an incredibly time and manpower intensive process. To make it worse, many brokers across the country are still using outdated processes for applicant data collection and mortgage approval. Meanwhile, the modern customer exists in a digital world, and is crying out for streamlined processes that allow them to quickly and simply apply for loans.

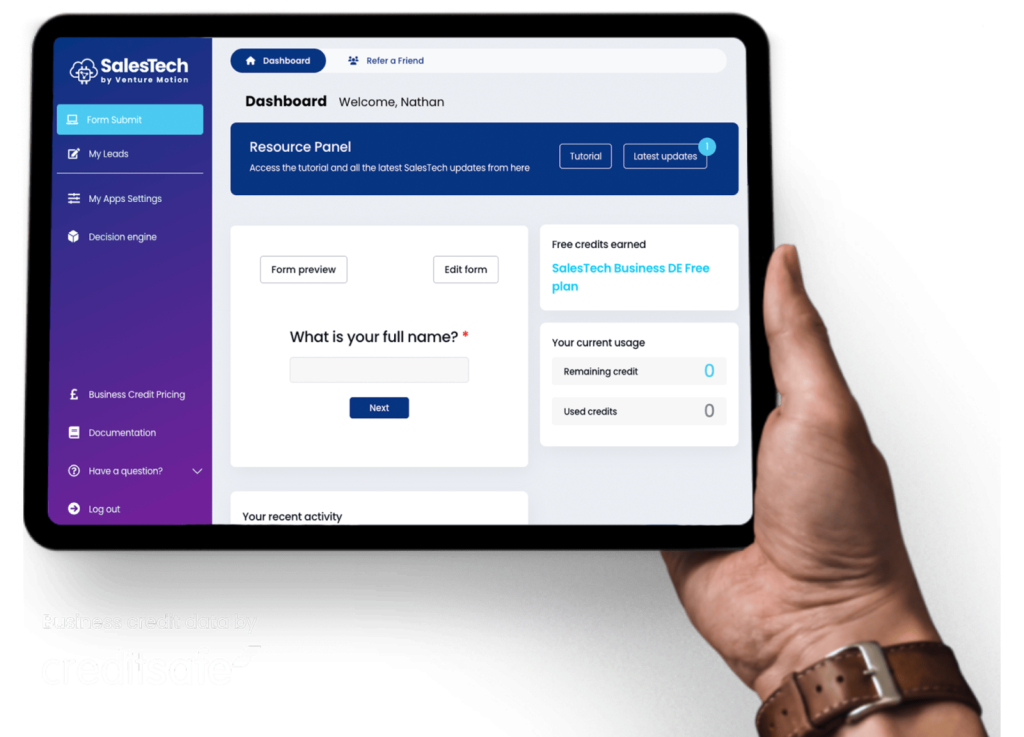

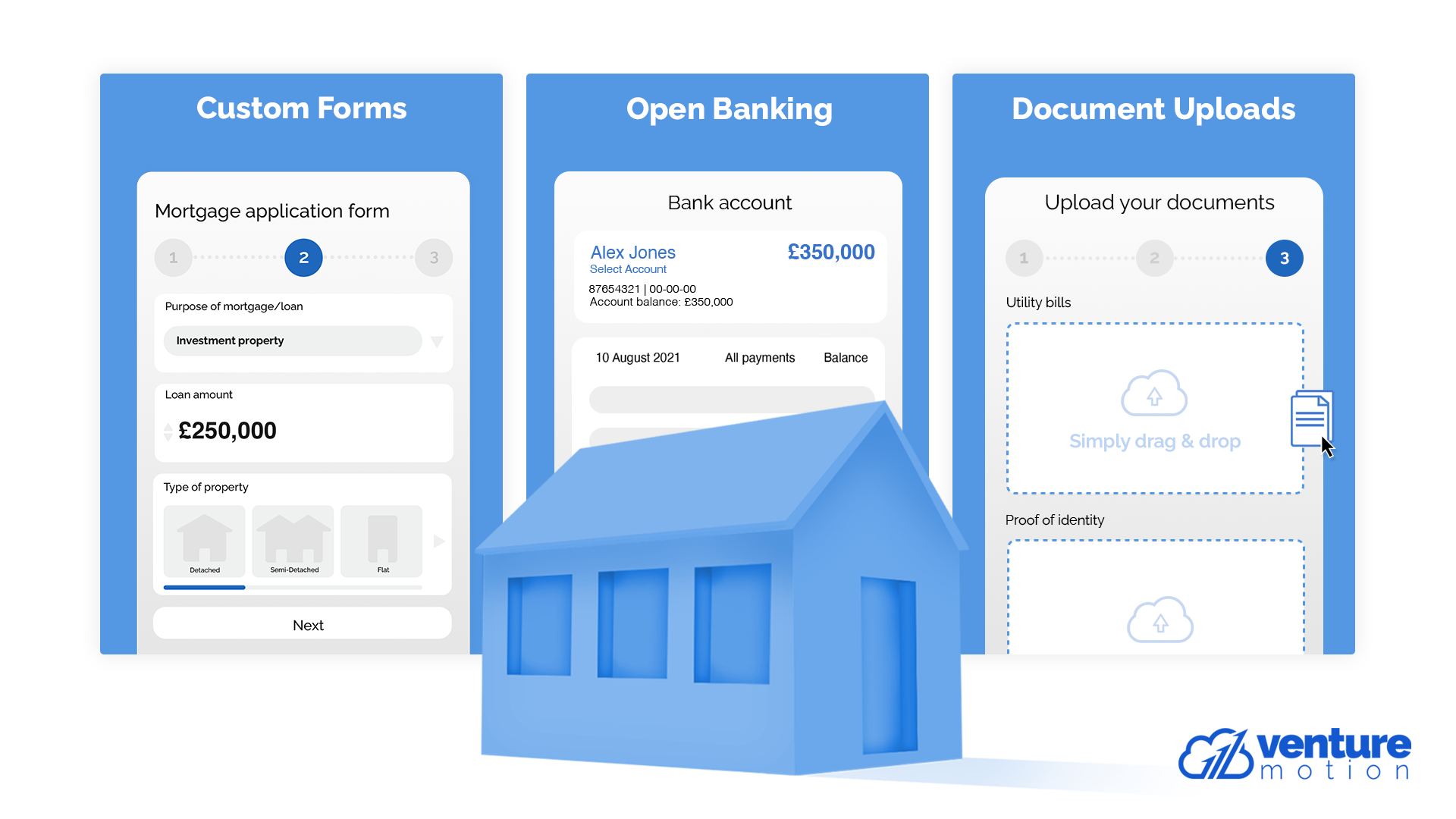

This brings us on to mortgage underwriting software and the power that it puts into the hands of brokers to deliver a better experience to applicants. Automating mortgage workflows revolutionises the entire lending process. With access to an automated underwriting solution such as our own LendTech platform, brokers have full control over custom application forms, open banking tools and can give applicants the ability to upload documents for processing by an automated mortgage underwriting decision engine.

Automated underwriting makes the entire application process far simpler for applicants, and far more efficient and profitable for brokers and lenders.

The benefits of automated mortgage underwriting

The key benefits of automated mortgage approval in contrast to traditional manual underwriting can be broken into two areas: the benefits for the lender, and the benefits for the applicant. For brokers, the efficiency brought by automations is most important. Once automated, underwriting teams will see an inevitable boost to productivity, being able to focus on only the most important areas, rather than spending hours on paper documents.

Automation systems like LendTech also eliminate possibility for human error when scanning for errors. Based entirely on your own criteria, our automation platform scans applicant bank statements with either open banking technology, or through digitised document uploads, to highlight any potential issues with an application.

On the other side of things, customers will come to appreciate the offerings of brokers utilising automated underwriting. The entire application process will quickly become a seamless process for any applicant, with easy-to-understand custom forms and open banking technology reducing the amount of effort required from the applicant to apply for a loan.

Once all necessary customer information is acquired, our decision engine reduces the time the customer has to wait for approval or denial down to mere seconds. Based entirely on criteria that you set, the decision engine analyses all data to provide your customers with a clear approval or denial in just seconds.

How you can automate mortgage underwriting

As a mortgage broker, you’ve no doubt been made aware of mortgage automation software in the past, but the idea of completely revitalising your existing processes can feel overwhelming. That’s where we come in.

At Venture Motion, we aim to offer easy-to-use automations at an affordable price point. Our LendTech platform is suitable for any mortgage brokers or lenders looking to take their application process to the next level. Using a module-based series of solutions, we provide an entirely bespoke automation solution that allows you to cater the automations you’re using to your business and customer base.

For more information, click below and start building your new automation solution today.