The alternative finance industry is constantly growing. Whether you’ve only just taken those first tentative steps into the financial services sector or are a lending industry veteran, ensuring you’re making expert credit checks available is essential. Credit checking for customers is so important, whether you’re in the credit industry, or are just looking to offer loans and financing to visitors to your website.

Customer credit checks are essential to the operation of an increasingly wider range of businesses and, even if you’ve been offering them for a long time, there’s a good chance there’s room for improvement. Are you a newbie wondering how to perform credit checks on customers in the first place? Are you already established in the industry and looking for ways to streamline and automate your credit checking process? Whoever you are, our guide is for you.

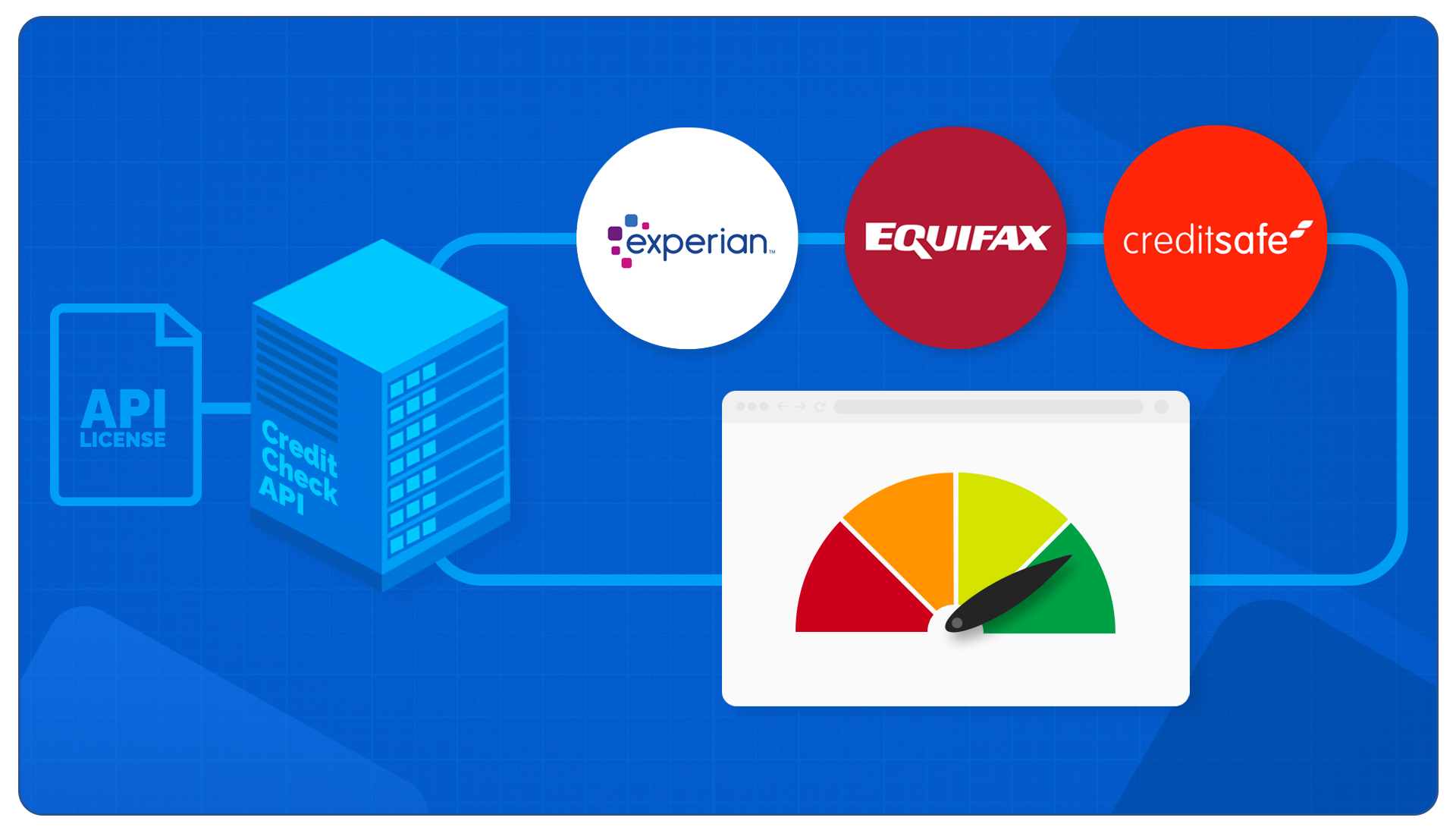

Credit checking APIs

Integrating credit checking technology into your business is the most obvious way to give you the ability to perform customer credit checks. Credit checking APIs are supplied directly from major credit agencies like Experian, Equifax and Credit Safe, allowing your business to make the use of the power and services of some of the world’s largest credit checking companies.

But what is actually involved in the customer credit check process when you’re using a credit checking API? Once you have the licence to use a credit agency’s API, the process is quite straightforward, but will require some technical know-how.

For the most efficient credit checks possible you’ll want to fully integrate the API of your choice into your existing business processes. This will allow you to quickly stream the credit checking data into your systems, workflows and products, giving you access to a raft of data to benefit your sales, marketing, credit, risk and compliance solutions.

To discover more about credit checking API integration, you can check out our API integration services and get in touch with our team of automation experts.

Other ways to check customer credit

Customer credit approval doesn’t always have to involve the incorporation of a major credit checking company. In fact there are a multitude of methods to approve applicants for your financial services.

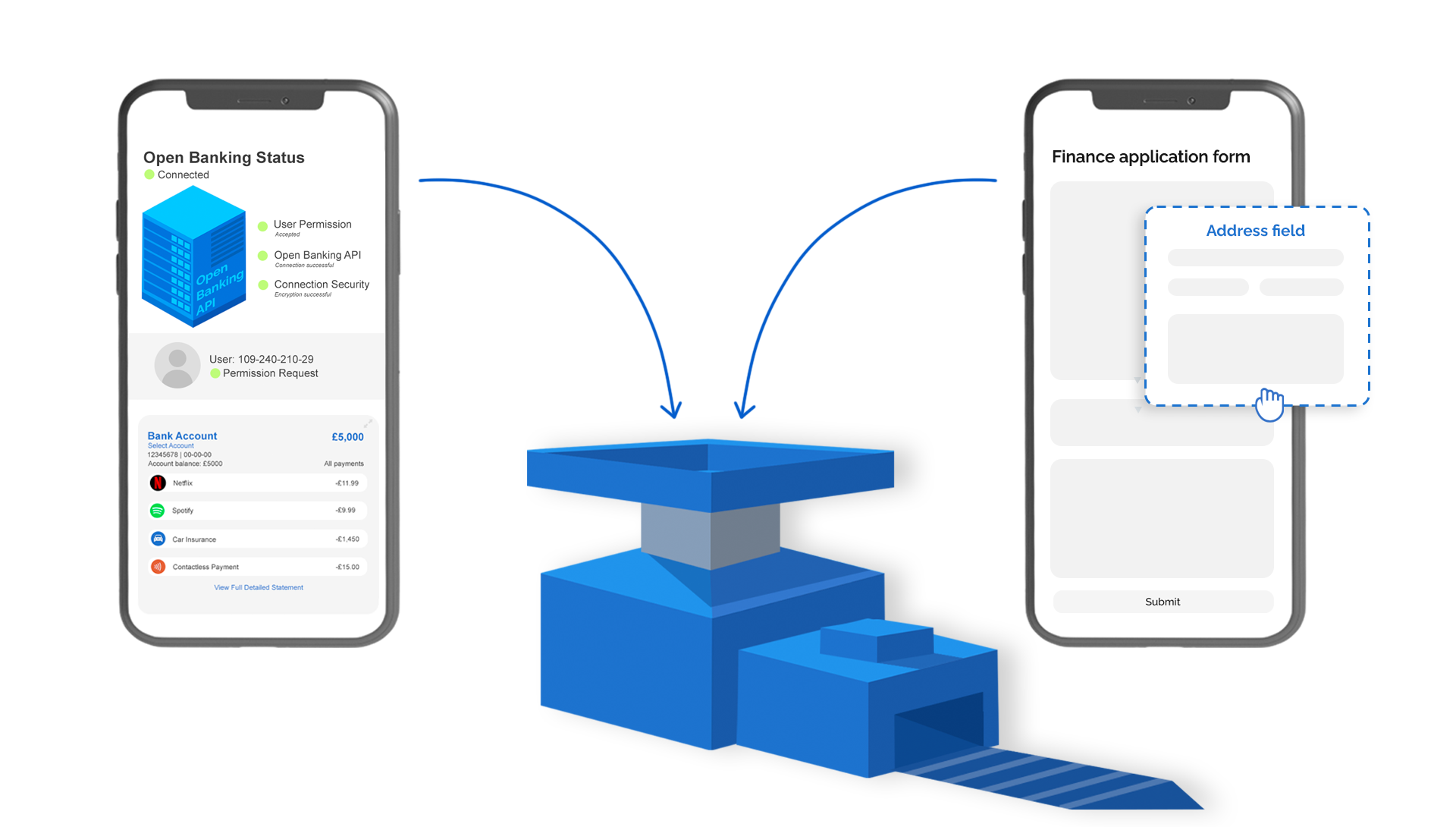

Creating custom forms built around the services that you offer is a great way to filter out applicants to only the ones you’re most likely to approve. Combine this with real-time access to applicant bank statements with Open Banking technology and you’ll be on track to offering an incredibly streamlined customer credit checking process.

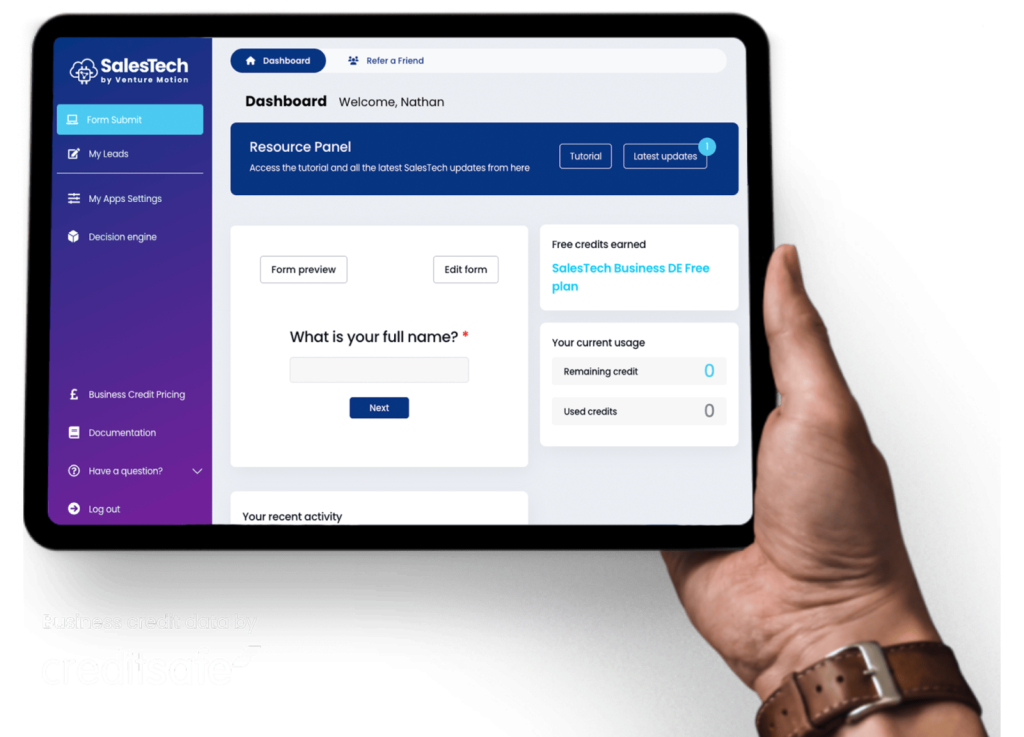

With our LendTech platform, you can integrate all of this technology (and more) into your business. We build revenue-driving automations and integrations for all types of finance business, so whatever technological improvements your business needs, get in touch with Venture Motion to find out how we can help.