Effectively carrying out due diligence on a company with Companies House data

Conducting effective due diligence on a business is essential to company’s operating in a range of sectors. Whether involved in accounting, business lending and brokerage, property, insurance or any of the other myriad industries where accurate due diligence is of the utmost importance, you’ll know how difficult it can be to do effectively and with a high degree of accuracy.

Many businesses will already utilise Companies House as a part of their due diligence process, but often without using the most efficient methods. Manual Companies House lookups take time and resources away from areas that could be spent building your own business, while also not making full use of the data available. Considering the data on offer from Companies House is valued at over £3 billion, if you’re not making the most of it, one of your competitors will be, and you could find yourself left behind.

So how can you carry out due diligence on a company by efficiently making use of data from Companies House?

How do you check the legitimacy of a business?

With Companies House data, you can look up the information necessary to determine whether or not the company you’re dealing with is who they say they are, a critical aspect of the due diligence process. With Companies House data, you’ll be able to ensure the business in question is registered, the date of incorporation, address and director details. All of this is an essential aspect of due diligence.

Once you’re confident that you’re dealing with a company that actually exists and that you’re talking to the right people, you can delve further into the data to enhance the legitimacy of the business.

By accessing the data highlighting the company’s annual financial statements and shareholder details, you can also understand the legitimacy and financial stability of the company at a more granular level. Shareholder information is an excellent way to build on your understanding of a company’s ownership and funding structure, while the financial statements will provide insight into the general financial health of the business.

How do you check if a company has a CCJ?

County court judgements (CCJs) can have significant implications for your due diligence process. A CCJ is a court order issued against businesses that have failed to repay a debt and, therefore, is a red flag for any business operating in the financial space.

Knowing a company has a CCJ can highlight creditworthiness issues, indicate potential problems with supply chains and even suggest a history of legal non-compliance. For many businesses, working with organisations who have a CCJ could be very risky, and may be entirely out of the question. As such, it is incredibly important to know whether or not a company has any CCJs as part of the due diligence process.

Once again, Companies House data can be your key to understanding whether or not a company holds any county court judgements. With access to a company’s filing history and financial statements through Companies House, you’ll have a much deeper understanding of a company’s financial history, any outstanding debts they may hold and if a CCJ has ever been levied against them.

Combining Companies House data with a business credit report is an even more effective way to accurately judge a company’s financial status.

How do you check if a company is in administration?

Knowing whether a company is in administration is critical to the due diligence process, suggesting the potential business client is experiencing a period of severe financial distress. While administrators will seek to avoid liquidation, if a company is in administration, the level of financial instability is likely to be a major red flag during your due diligence process.

As with CCJs, Companies House keeps records on whether a company is in administration as part of their filing history. Companies House’s data will show the administration documents; including a notice of appointment of an administration and a statement of affairs, that will indicate whether the company is in administration. Of course, simply being in administration may not be reason enough not to work with a business, so it’s important to set criteria that is important to you and cross-reference the company’s status against other financial data before making major decisions.

How to use Companies House for due diligence

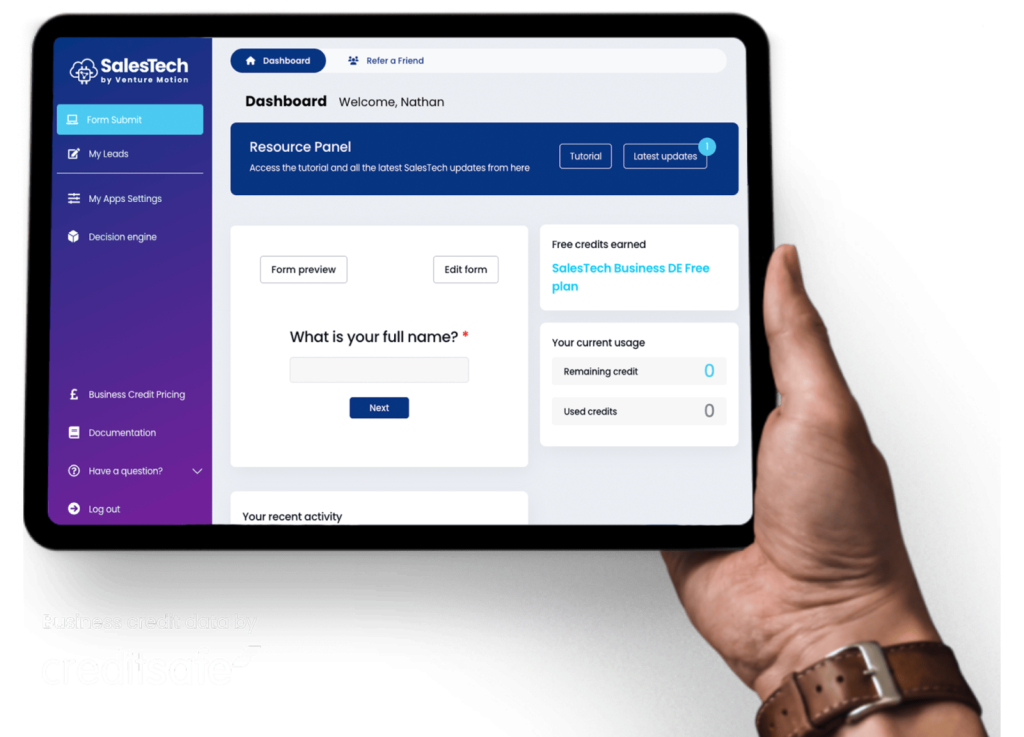

When it comes to performing due diligence on a business client, Companies House is an incredibly valuable tool. The information on offer through their database is second to none, and when used efficiently, can be a huge time and resource saver for your own organisation. That’s why we utilise this incredibly powerful tool as part of our SalesTech business intelligence platform.

With SalesTech, you’ll have full access to all of the data available with the Companies House API to enhance your due diligence process. Based on your custom criteria, our platform will automatically create reports, enriching your data and ensuring you spend your time and resources only where they are most important.

For more information on how to enrich your due diligence process with our business intelligence platform, get in touch with our team today.