What is a decision engine and how can one boost your business?

Decision engines can truly revolutionise the way that businesses operate. Whatever the sector a business is operating in, if decisions need to be made; having an automated platform to make those decisions will always bring value.

But what exactly is a decision engine and how do they work? As a relatively new addition to the digital arsenal, it’s really important to understand what decision engines are and how they can benefit you and your business before committing yourself to using one.

What is a decision engine?

Decision engines can be particularly useful for businesses operating in industries that have to deal with lots of application approvals and denials. The likes of recruitment, insurance, lending industries and many more can all seriously benefit from the use of a decision-making engine.

For more information on how decision engines work, you can read our in-depth guide to how our own decision engine works.

How credit decision engines boost your performance

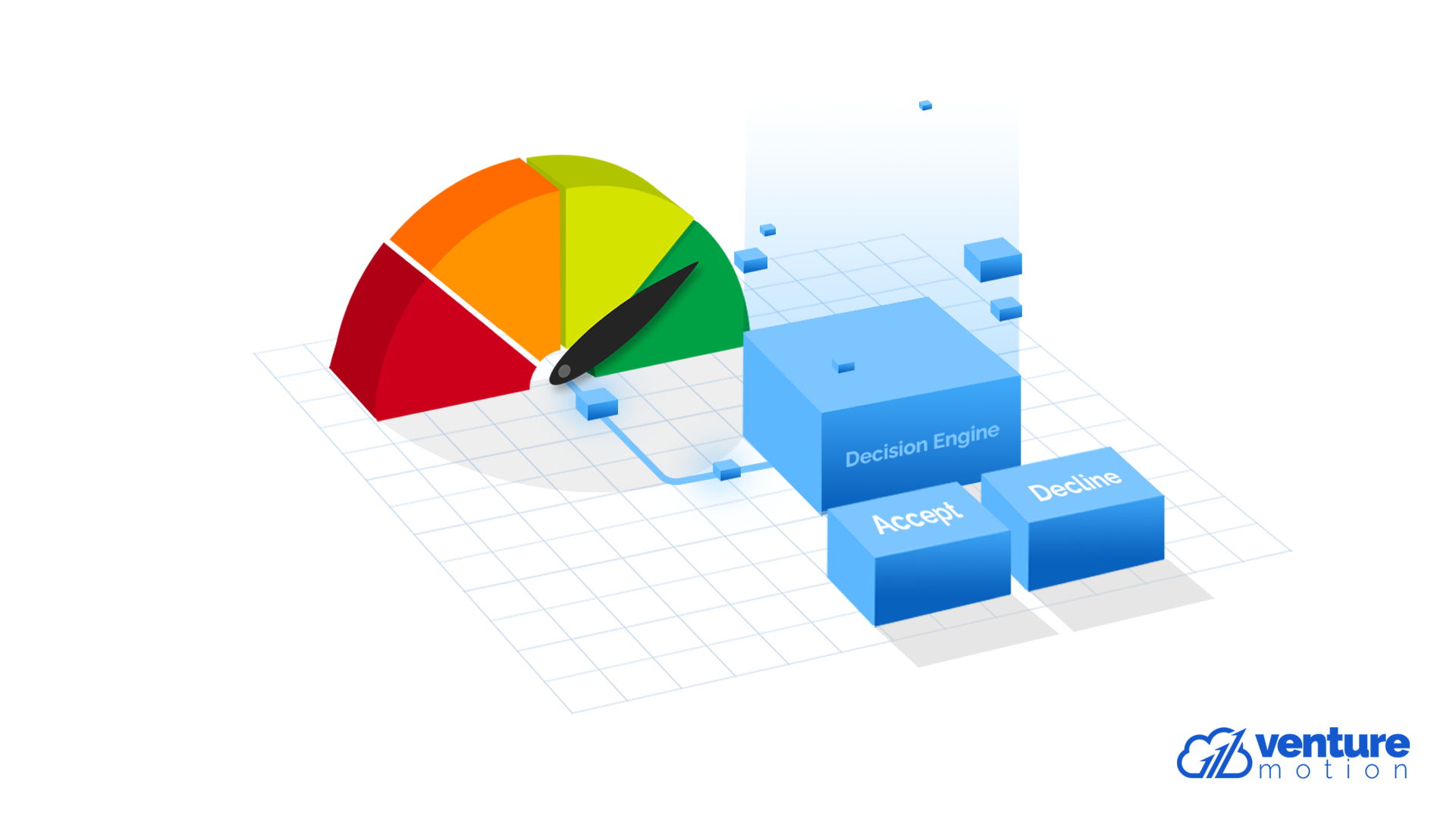

The main appeal of working a decision engine into your existing systems is the incredible performance boost that automation consistently brings. Nowhere is this more apparent than within the lending sector, with credit decision engines consistently boosting the performance of businesses by automating existing lending qualifications and workflows.

Our decision engine platform integrates with business credit data sources in real time to make custom logic-based decisions automatically. This gives businesses the power to close deals faster and scale their organisation without having to increase their headcount or ongoing costs.

Credit decision engines interlink with credit databases such as Creditsafe to provide access to incredibly valuable data. With access to business credit references, the decision engine can accurately assess the financial health and stability of a business, guaranteeing that any necessary criteria is being met.

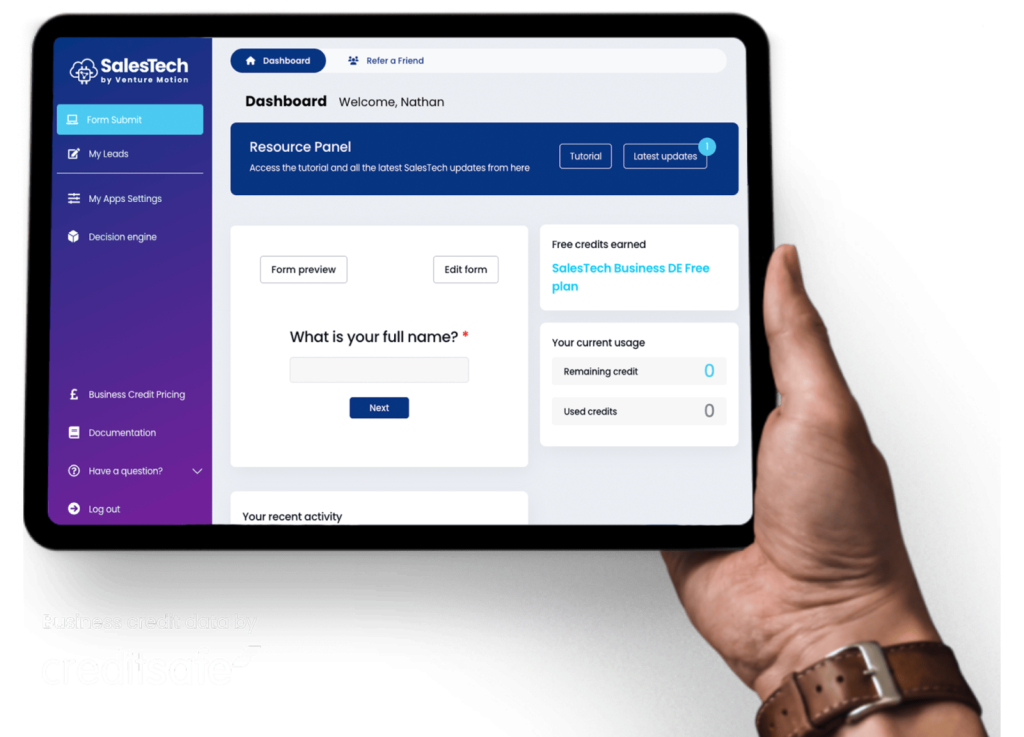

From entry-level credit decision engine software to a fully customisable, purpose-built decision engine platform, your credit-focused business will always benefit from even minor automations. However, it’s only with the truly bespoke and specialised platforms that your business can gain the most benefit.

A fully customisable decision engine platform gives businesses full control and freedom over the parameters used to approve or deny applicants for their services, all through the power of automation. Most lending businesses, in particular, can have quite complex criteria as part of the credit decisioning process. As such, ensuring you’re using the right lending decision engine is essential if you want to elevate your business with automations. This brings us to SalesTech, our own custom-built decision engine platform.